‘Small is Beautiful’ (Schumpeter, 1973), saying is proved in the world by the small and medium scale enterprises. Small and Micro Enterprises have been widely accepted as being vital to any economy given their role in job creation and their ability to foster entrepreneurship. Over the past decade, the Indian economy has demonstrated both remarkable acceleration in growth and employment and equally sharp deceleration. The role of SMEs is particularly critical in national efforts to eradicate poverty. It is evident from the 29.8 million enterprises across different industries giving 69 million employments in India. SMEs also serve as a breeding ground for emerging entrepreneurs as well as forming the backbone of the private sector. Development of small business is subject to access to adequate finance and lucrative markets.

Typically, Small and medium Enterprises defined or understood based on business whose personnel numbers falls below certain level. This certain level differs in different countries based on the countries social and economic structure. Small enterprises outnumber large companies by a wide margin and also employ many more people. SMEs are also said to be responsible for driving innovation and competition in many economic sectors. Small and medium enterprises typically employees 10-250 workers, form the backbone of modern economies and can be crucial engines of development through their role as seedbeds of innovation. In much of the developing world, though, SMEs are under-represented, stifled by perverse regulatory climates and poor access to inputs. A critical missing ingredient is often capital.

The SME sector contributes in the manufacturing output, employment and exports. It has emerged as a dynamic and vibrant sector of the economy which is expected to grow by over 8% per annum until 2020. Generating employment at low cost is the main advantage of this sector. Being highly heterogeneous, SMEs are of different size, producing variety of products and services and level of technology. It helps in the industrialization of rural and backward areas which would reduce regional imbalances.

Though there are many advantages from SMEs, their problems are also many in list. These problems are unique from large companies and MNCs. To state a few, the SMEs face problem of raw materials, poor marketing, lack of formal procedure and discipline, problem of under- utilization of capacity, lack of financial resource, human resources, infrastructure, technological backwardness, information divide, lack of innovations and most importantly competition in international market are some of the challenges for the Indian SMEs. If these problems can be minimized, the SMEs can provide a great support in the over-all development of the Indian industrial sector and can boost the Indian economy.

STATEMENT OF PROBLEM

The Small and Medium Enterprises are relatively under-represented in the global economy. They contribute between one quarter and one third of manufactured exports and account for, usually, less than 10% of FDI. In most national economies Small and Medium Enterprises make up more than 95% of market participants and contributed around 50% of direct value added or production. The reasons for this are many-fold. International activities expose SMEs to a more complex and risky business environment, for which, compared to larger firms, SMEs are relatively unprepared and less well-resourced. Some of these risks and complexities can be addressed by governments as they relate to the differing regulatory, administrative and policy environments that governments create. Increased levels of globalization can impact on SMEs in two main ways:

- On the one hand they open up opportunities. For example, SMEs which can grow quickly, which are niche exporters, or which are able to tie in with global supply chains are all able to take advantage of opportunities created by globalization.

- On the other hand, globalization poses an increased threat for SMEs which are unable or unwilling to compete. Given that labour is still less “globalised” than other factors, this poses political and social challenges for governments.

These two aspects of SMEs are taken into in depth study in the study.

OBJECTIVES OF THE STUDY

The study is mainly focused on the prospects and strategies of Small and Medium Enterprises with the following objectives by taking sugar industry of India as study area:

- To understand the status of Indian Small and Medium Enterprises in the international business

- To evaluate the challenges of Small and Medium Enterprises of India in today’s business environment

- To study the strategies adopted in small and Medium Enterprises to discover the international business career by taking sugar industry as an example.

LITERATURE REVIEW

European Commission (2007) bought out the major difficulties to SMEs around the world where the lack of capita and information are prominent one which can also be seen in the context of India. In the Indian context, SMEs are those engaging up to 4 people in most cases family members or employing capital amounting up to 5 lakhs. Vasu and Jayachandra (2014) discussed about the growth and performance of MSMEs and also listed out the problems faced by SMEs in India. Shirala shetti (2014) covered growth, performance and contribution of SMEs to GDP and also mentioned about the problems faced by SMEs located in Dharwad district of Karnataka State. Rajib Lahiri (2012), the study made an attempt to critically analyze the definition aspect of MSMEs and explore the opportunities enjoyed and the constraints faced by them in the era of globalization after analyzing the performance of SMEs in India during the pre and post liberalization period. The study revealed that except marginal increase in growth rate in employment generation, the growth rate in other parameters is not encouraging during the liberalization period. Neeru Garg (2014) made an attempt to highlight the growth of this sector and analyze various problems and challenges faced by SME sector in India in general.

Further, a study by Aruna (2015) recently in Andra Pradesh also revealed major hurdles of SMEs are financial problems and issues relating to raw materials and power. Similar result is also found by Sangitha (2002) who conducted a macro level study on Indian SMEs. Suneetha and Sankaraiah (2014) bought out micro level picture using Kadapa district of Andra Pradesh and witnessed that SMEs in this district are no different than other country SMEs. Ventakesh and Ventakeshwaralu (2017) argued that sugar industry in India creates 7.5 percent of employment. With such huge employment, the sector faces certain critical problems.

In recent year (2019-20) the sugar production is expected to decline by 14.26 percent (ISMA, 2019). This present paper is an effort to understand those problems for taking the case study approach.

RESEARCH METHODOLOGY

The descriptive methodology has been used to collect data. The explanation of the data is more qualitative than on quantitative terms. Secondary sources of data are used. Data published by various institutions such as Government of India, World Bank, Consultative Group to Assist the Poor (CGAP), Reserve Bank of India (RBI), National Bank for Agriculture and Rural Development (NABARD), Organization for Economic co-operation and Development (OECD), etc are used for the purpose of the present paper.

DEFINITION OF SME IN INDIA

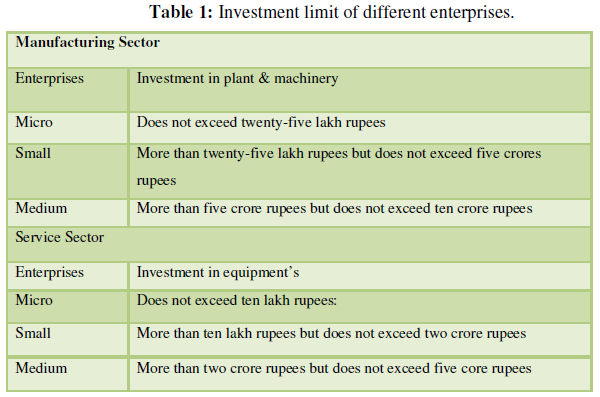

Definitions of Small & Medium Enterprises In accordance with the provision of Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 the Small and Medium Enterprises (SME) are classified in two Classes (Table 1):

- Manufacturing Enterprises-the enterprises engaged in the manufacture or production of goods pertaining to any industry specified in the first schedule to the industries (Development and Regulation Act, 1951) or employing plant and machinery in the process of value addition to the final product having a distinct name or character or use. The Manufacturing Enterprise is defined in terms of investment in Plant &Machinery.

- Service Enterprises: -The enterprises engaged in providing or rendering of services and are defined in terms of investment in equipment.

STATUS OF SMES IN INDIA

Like in any other developing countries, in India also, SMEs play a very significant role in terms of their balanced and sustainable growth, employment generation, development of entrepreneurial skills and contribution to export earnings. As at the end of March 2005, there were around 12.0 million units - constituting 95 per cent of the industrial units in the country which produced 80000 items with associated technology varying from traditional to state-of-art. These units provide employment to nearly 24.9 million persons, account for 40 per cent of the value added in the manufacturing sector, 34 per cent of total national exports and 7 per cent of GDP during2003-04.

SMEs are the backbone of the Indian economy. It acts as a breeding ground for entrepreneurs to grow from small - big. India has nearly 12 million SMEs, which is almost 50% of industrial output and 42% of India’s total export. The reasons are: a. Investment of less capital b. High contribution to domestic products c. Extensive promotion and support by Government d. Significant export earnings e. Operational flexibility f. Man power training, machinery procurement g. Capacity to develop appropriate indigenous technology. h. Technology- oriented industries

Notwithstanding the increase in credit outstanding to the sector, access to adequate and timely credit at a reasonable cost is a critical problem faced by this sector. The statistics compiled in the Fourth Census of MSME sector September 2009, revealed that only 5.18% of the units (both registered and unregistered) had availed of finance through institutional sources, 2.05% had finance from non-institutional sources; the majority of units i.e., 92.77% had no finance or depended on self-finance. Thus, the extent of financial exclusion in the sector is very high. But this is not entirely unexpected because if one looks at the financial exclusion in our country in general, then MSMEs cannot remain unaffected by it. But there is a need to bridge this gap through enabling policies and the Government of India needs to play a catalytic role to cater to the needs of this sector.

INDIAN SMES AND GLOBALIZATION

With the advent of planned economy from 1951 and the subsequent industrial policy followed by Government of India, both planners and Government earmarked a special role for small-scale industries and medium scale industries in the Indian economy. Certain products were reserved for small-scale units for a long time, though this list of products is decreasing due to change in industrial policies and climate.

SMEs always represented the model of socio-economic policies of Government of India which emphasized judicious use of foreign exchange for import of capital goods and inputs; labour intensive mode of production; employment generation; non concentration of diffusion of economic power in the hands of few (as in the case of big houses); discouraging monopolistic practices of production and marketing; and finally effective contribution to foreign exchange earning of the nation with low import-intensive operations. It was also coupled with the policy of de-concentration of industrial activities in few geographical centers. It can be observed that by and large, SMEs in India met the expectations of the Government in this respect. SMEs in spite of having low capital base with concentration of functions in one / two persons, inadequate exposure to international environment and inability to face impact of WTO regime, inadequate contribution towards R & D and lack of professionalism, SMEs have made significant contribution toward technological development and exports.

SMEs have been established in almost all-major sectors in the Indian industry such as: Food Processing; Agricultural Inputs; Chemicals & Pharmaceuticals Engineering; Electricals; Electronics; Electro-medical equipment; Textiles and Garments; Leather and leather goods; Meat products; Bio-engineering; Sports goods; Plastics products; Computer Software, etc. The contribution of MSEs in the Indian economic development has been immense. The sector currently accounts for about 39 per cent of the manufacturing output and around 33 percent of the total exports of the country. There are approximately 1.3 crore MSEs which employ nearly 3 crore people. The sector contributes close to 7 per cent of our GDP. Thus, special thrust by the Government to the sector has been consistent with the objectives of employment generation, regional dispersal of industries and fostering of entrepreneurship.

SUGAR INDUSTRY AND GLOBALIZATION

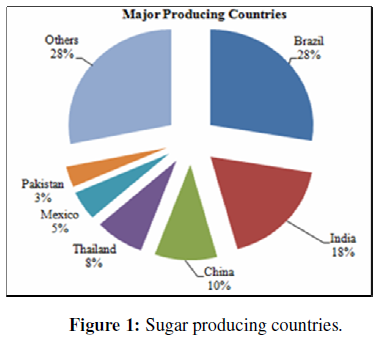

The major countries which have the highest sugar productions are Brazil, India, China, Pakistan, Mexico, Cuba, Australia, and Argentina. Brazil (22%) is the major producer followed by India (15%) and EU (11%). Brazil, India and the EU control over 48% of the global sugar production. India is the largest consumer of sugar in the world.

Considerable expansion took place until 1980, when world sugar consumption reached nearly 90 million tonnes, i.e., an annual growth rate of 3.1%. After going through a sluggish growth in the 1990s, which hardly exceeded 2.2% per annum, sugar consumption has grown at a healthy rate since the early 2000s, notably in Asia (+4.9% p.a.), the Middle-East (+4.6% p.a.) and Africa (+4.1% p.a.). Today, a world population of just above 7 billion people, of which 75% (5,5 billion) are concentrated in Asia (4.4 billion) and Africa (1.1 billion), consumes roughly 173 million tonnes of sugar, that is 24 kg per capita on average, with the lowest level seen in the most populous continent (Africa and Asia with average at respectively 16.8 and 17.3 kg per capita) and the highest in America and Europe (average at respectively 43.8 kg and 36.7kg percapita).

The 10 largest sugar consuming nations represent roughly two-thirds of total world consumption. White sugar consumption in developed countries can be considered as saturated (flat/low population growth and maturity of food markets), whereas developing countries are considered as growing markets, particularly in Asia, and, to a lesser extent, in the Middle-East and Africa.

INDIAN SCENARIO

In India, sugar industry is the second largest industry after textiles. The country is the second largest sugar producer in the world (accounting 13% of the world’s sugar production). The sub- tropical region (Uttar Pradesh) contributes almost 60% of India’s total sugar production, while the balance comes from the tropical region, mainly from Tamil Nadu, Karnataka, Maharashtra and Madhya Pradesh (Figure 1).

The Indian sugar industry is marked by co-existence of different ownership and management structures since the beginning of the 20th century. At one extreme, there are privately owned sugar mills in Uttar Pradesh that

procure sugarcane from nearby cane growers. At the other extreme, there are cooperative factories owned and managed jointly by farmers, especially in the western state of Gujarat and Maharashtra. There are state owned factories in both the states and state-managed cooperatives in Uttar Pradesh. Sugar is India’s second largest agro-processing industry, with around 400 operating mills as of March 2005. The 203 cooperatives are a dominant component of the industry, which accounts for over 56% of the total capacity [@19 mt per annum] nearly 83 [or 41% of total cooperatives] are concentrated in Maharashtra, followed by Uttar Pradesh with 28 mills.

Regarding the structure of sugar industry in India, the year 2005 show that there are 20 sugar producing states in India but the combined share of 12 major states is about 97.72 percent. Among 12 major sugar producing states, the sugar firms of Uttar-Pradesh (UP) and Maharashtra are contributing about 27.06 percent and 30.12 percent, respectively to the total sugar production of India. The sugar manufacturing industry is highly fragmented with none of the players having a market share greater than 3%. Although cooperatives account for around 43% of the total production in the sugar industry, their share has gradually declined.

Sugar plant size (in terms of cane crushed per day) is the main criteria for determining the productivity and viability of the sugar industry. In India, because of traditional industry like Gur and khandsari manufacturers fragmentation, lesser cane availability, and competition for cane, has resulted in lower plant sizes. Sugar mills in India have capacities ranging from below 1,250 tonnes crushed per day (tcd)

SUGAR PRODUCTION IN INDIA

In the 2014-15 crushing season, the sugar production of India has seen an increase of 11.5 percent. The Indian Sugar Mills Association (ISMA) says that as of 31st March, India had produced 24.72 million tonnes of sugar and this was an addition of 2.84 million tonnes to the sugar production of 2013-14. It is estimated that in the 2015-16 season, 24.8 million tonnes of sugar will be consumed. ISMA estimates that due to the increased production in the year gone by, there will be a carryover stock of 8.5 million tonnes. There will be 2.5 million tonnes more than what is thought to be the standard requirement in these cases.

It is expected that in 2017, Indians will be consuming almost 28.5 million tonnes of sugar. Maharashtra is traditionally the leader when it comes to sugar production in India. Before Maharashtra, Uttar Pradesh was the leader. There are several reasons as to why Maharashtra occupies this place in the pantheon of Indian states that produce sugar. The state has a longer crushing period compared to other states and its rate of recovery is also significantly higher.

Maharashtra currently has almost 25 percent of the sugar mills operating in India and it accounts for nearly 30 percent of the entire sugar produced in India. In fact, the sugar mills in Maharashtra are supposed to be the biggest in the country. Most of these mills are located at the river valleys in the western stretches of the Maharashtra Plateau. Ahmednagar is among the leading centre of sugar production along with Kolhapur, Pune, Satara, Nasik and Sholapur. INDIAN SUGAR INDUSTRY CONSUMPTION

INDIAN SUGAR INDUSTRY CONSUMPTION

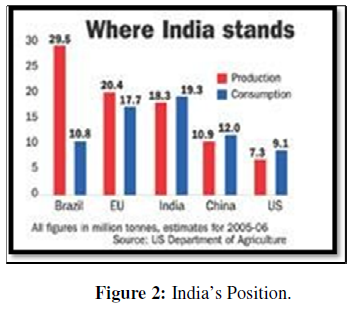

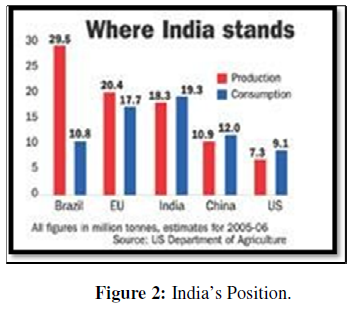

Consumption of sugar and related sweeteners in India has increased in the last few years. One of the major reasons for the increasing demand for sugar is the growing population of India as well as improving economic conditions. Majority of the consumers of the sugar that is produced directly by mills are bakeries, local sweets and candy manufacturers. Together with the soft drink makers, they comprise almost 60 percent of the clientele (Figure 2). The major consumers of khandsari are locally operating sweets establishments. Gur is also used in the rural areas in its normal form as a sweetener as well as feed. Biscuit manufacturers, food products companies, pharmaceutical setups, and hotels and restaurants also consume fair quantities of sugar.

As has been said already, almost 2.6 lakh people are directly dependent on the sugar industry for their livelihood. Sugar industry is an agricultural industry that still provides the maximum amount of employment in India. The Indian Sugar Industry, with an annual productive capacity of over 25 MMT, stands out to be the second largest in the world after Brazil, accounting for around 15% of the global sugar production. The country consumes approximately 22 MT of sugar annually, with Maharashtra contributing over 60% of it while the rest of the output come from states like Tamil Nadu, Karnataka, Uttar Pradesh and Madhya Pradesh. The sufficient and well distributed monsoon rains, rapid population growth and substantial increases in sugar production capacity have made India the largest consumer and second largest producer of sugar in the world. Highly fragmented with organized and unorganized players, the sector supports over 50 million farmers and their families, making significant contribution towards socio- economic development in the rural areas of the India.

WORLD SUGAR EXPORT AND INDIA

The world sugar production has been increasing steadily at a CAGR of 1.5 percent. Currently the total world sugar production stands at 150 million MT of sugar. Brazil, India, China and U.S.A are the major sugar producing countries accounting for 45 percent of the total sugar production. EU collectively produces around 14 percent of the total sugar production. Brazil is the largest producer of sugar has increased its production by 5.7 percent CAGR over the last 7 years since deregulation in 1999- 2000. India is the second largest producer and its sugar production has increased consistently except in years which were drought affected.

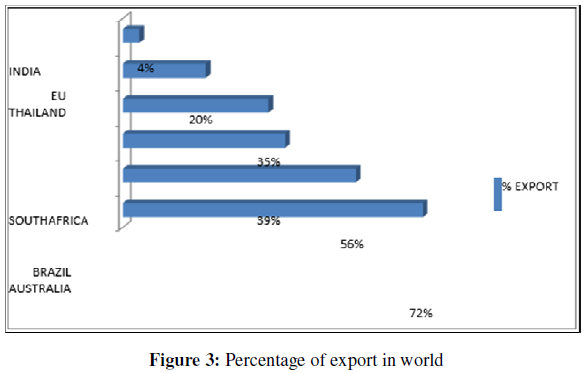

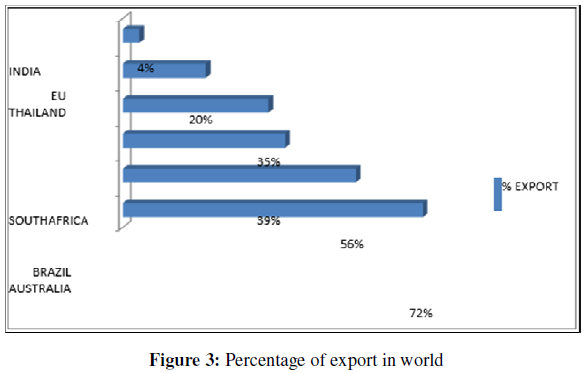

The major producers of sugar in the world are also the leading exporters, and are highly dependent on the world trade. Australia exports around 72 percent of its production, while Brazil exports 56 percent of its production (Figure 3). India is however unique, as it has the world's largest consumption market. India's dependence on the world trade is marginal and therefore, it is largely insulated from the global price variations. In case of a global surplus though, domestic prices tend to get influenced by low global prices since exports from India are less viable. Historically, India has used the world trade to manage its surplus and deficit, as it is typically self-sufficient in sugar. At no point in the last 7 years has India imported or exported more than 2 percent of the total world sugar trade.

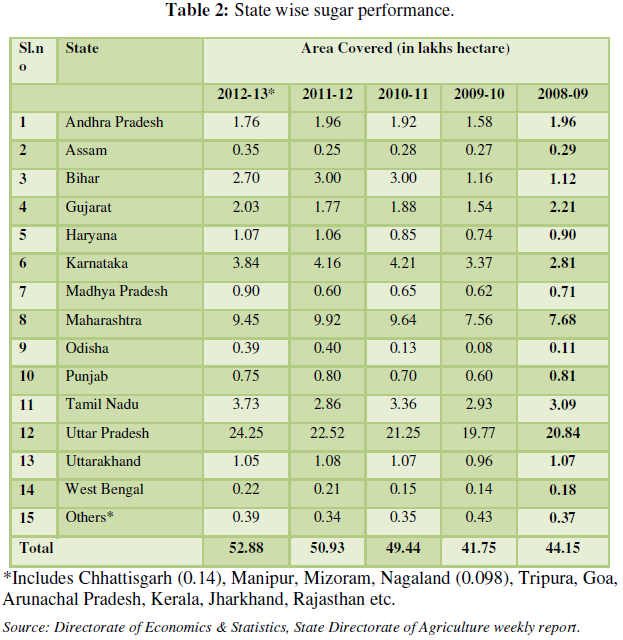

STATE WISE SUGAR PRODUCTIVITY

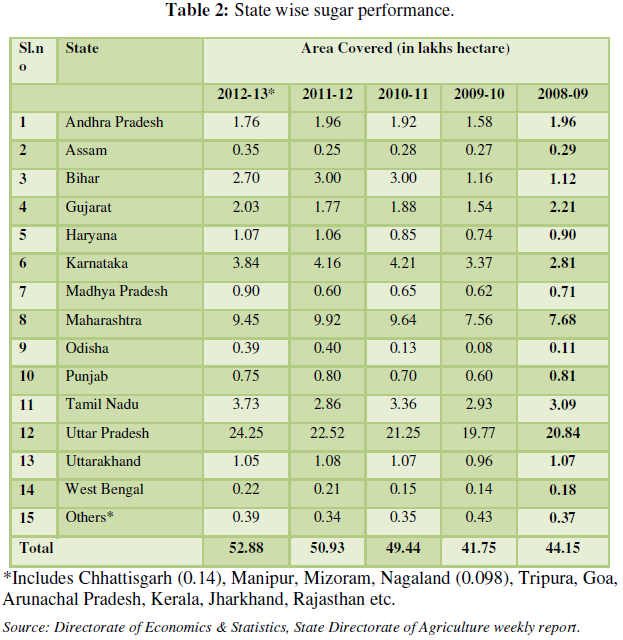

Sugar companies have been established in large sugarcane growing states like Uttar Pradesh, Maharashtra, Karnataka, Gujarat, Tamil Nadu, and Andhra Pradesh and these six states contributing more than 85% of total sugar production in the India while, over 60% of total production is together contributed by Uttar Pradesh (UP) and Maharashtra.

Sugar output in Uttar Pradesh, the country’s second biggest sugar producing state, rose by 7% to 7.43 MT till April of this year on account of better recoveries especially in west and central zones of the state. Sugar recovery was higher at 9.19% and mills crushed 5% more sugarcane than last year. It is believed that UP is likely to close this year with a total sugar production of around 75 lakh tonnes after crushing approximately 813.5 lakh tonne of cane. The recovery, too, improved, with the eastern and central parts of the state showing better results. This has pushed sugar production from the state up by 7% during FY13 as compared to SY12 season.

However, sugar production in Maharashtra, the country’s top sugar producing state, fell by 10% to 7.97 MT so far from over the year-ago period on account of severe drought in some parts of the state. Sugar recovery remained lower at 11.40% and mills crushed 8% less sugarcane. Marathwada, which contributes up to 20% to the total state sugar production, produced 22% lesser sugar than last year as the region is reeling under water shortage. Similarly, sugar production from Pune and Kolhapur zone remained lower by 6% so far.

At present, only four mills in Satara and Nagpur are under operations, against 40 last year. In case of Karnataka, sugar production declined to 3.36 MT till April of this year, as against 3.72 MT in the same period corresponding year. The recovery rate was lower at 10.44% in the state, where five mills are still crushing while sugar production in Tamil Nadu, where 29 mills are still operation, remained slightly lower at 1.57 MT so far, while in Andhra Pradesh the output was lower at 9,90,000 tonnes, as against 11,10,000 tonnes in the year period (Table 2).

PESTEL ANALYSIS OF SUGAR INDUSTRY

The PESTEL analysis of the Indian Sugar industry has been analyzed in this section:

- a) Political Factors: The Indian sugar industry works under high political intervention. Farmers usually deal through co-operative society, where the local political parties have a strong influence on the finance disbursement and preferences. Even though to protect the sugar farmers, the government introduced Fair and Remunerative Pricing (FRP), the situation has not changed much.

- b) Economic Factors: The sugarcane production in the country constitute almost 2.2-2.7 percent of India’s total cropped area. Even though there is annual volatility, the contribution of this crop to the total GDP stands almost 0.7 percent (2018-19). In addition, the sugar industry pays almost Rs. 1700 crores to various state government in the form of excise duties and purchase tax (now GST) on sugar cane.

- c) Social Factors: The employment generation of this industry is a remarkable one. Almost 7.5 percent of the rural population in the country depends on sugarcane farming. The direct employment of the industry is approx. 2 million and there is also significant indirect employment generation through various ancillary services.

d) Technological Factors: Indian sugar mills suffer from lower capacity utilization. The food and public distribution of India (FPD) department has initiated the technological upgradation in sugar mills. Even department of science and technology has collaborated with the government to improve the plant efficiencies of the mills, including the introduction of energy saving technology and reduction of utilization of major inputs

e) Environmental Factors: The major benefit of the sugar mill is the bi-product of the sugarcane. It is held that ethanol emits less carbon dioxide than crude oil and can supplement the same. The use of ethanol not only benefits environment, but also helps the industry to earn carbon credits.

f) Legal Factors: Legal aspects of the sugar cane affect the industry and producers. But government is trying to support the sugarcane producers with the enactment of various acts which will provide both financial support and protect from international competition.

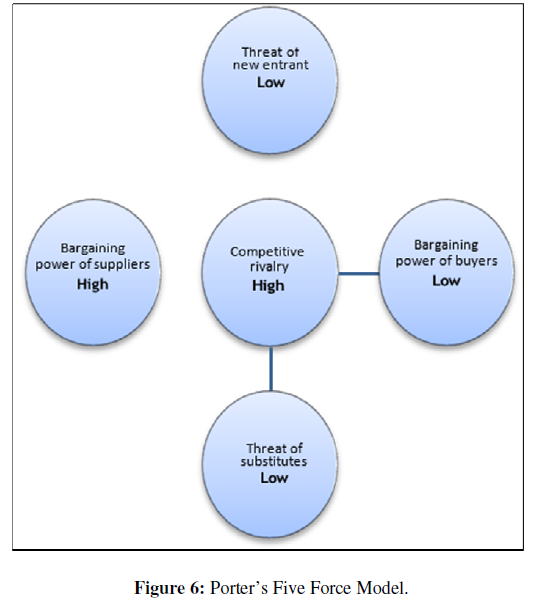

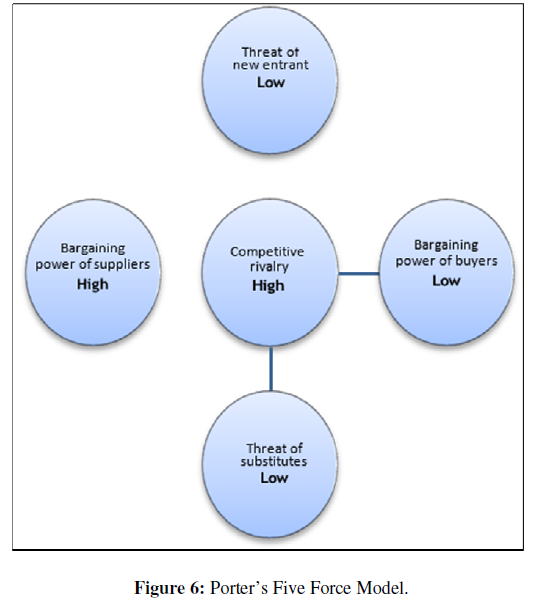

To determine industry attractiveness and long-run industry profitability of the Indian Sugar Industry, we chose to apply the Porter’s five forces in our analysis (Figure 6). Porter’s five forces are:

- Barriers to Entry and exit: The Indian Sugar Industry is characterized with modest entry and exit barriers. Integrated business model and increasing capital requirement in the industry restrict new entrants. The Government earlier used to give incentives to set up new plants by granting higher free sales quota for the first five to eight years of operations that had led to mushrooming of small units. This incentive has been withdrawn and the new sugar units are required to comply with the levy quota regulation from first year of operations. The GOI has also put restriction on setting up of two sugar factories within the radius of 15Kms.

- Threat of substitutes: Being an essential commodity the demand for sugar is not elastic. Alternate sweeteners to refined sugar in India are gur and khandsari. But with increased per capita income and easy availability of sugar at competitive rates, use of gur and khandsari is seeing a downward trend and is mostly confined to rural areas. Hence, threat of substitute is low in the industry.

- Buyer bargaining power: Indian sugar market is highly regulated by the Govt. influencing distribution, purchase price of levy sugar and the free sale quota releases for sugar. Hence, buyer’s power is highly restricted in this sector.

- Supplier bargaining power: Allocation of the area from where the sugarcane can be procured is allocated by the government. The Sugar mills have no choice but to purchase all the Cane sold to them, even if it exceeds their requirement. Sugar producers are not allowed to own cane fields in India. Though recent sugar de-control is likely to give higher pricing power to the mills, the government still can influence the prices with its PDS system.

- Industry Competition: Competitiveness among the Indian sugar players is high. With around 500 units engaged in production of sugar, the industry is highly fragmented. Private Individual players do not have big market share. Cooperatives are relatively high as they account for more than 50% of the industry’s production.

FACILITATING SMES ACCESS TO INTERNATIONAL MARKETS

During the past decade there have been steady technological and structural changes which have made it easier for SMEs to participate in the international economy. Advances in ICTs, and in particular, the Internet, have been a major factor in facilitating information flows and expanding the market potential of smaller firms. Governments have been making efforts to reduce barriers to international business activity, at the global and especially at the regional level.

However, SMEs are still relatively under-represented in the global economy. SMEs only contribute between one quarter and one third of manufactured exports and account for a very small share, usually less than 10%, of foreign direct investment (FDI) in India (Schreyer, 1996; Hall, 2002; Sakai, 2002). In most national economies SMEs make up more than 95% of market participants, and contribute around 50% of direct value added or production. The reasons for such small contribution by Indian firms are manifold. Globalization has exposed SMEs to a more complex and risky business environment. Compared to larger firms, SMEs are relatively unprepared and less well-resourced. Some of these risks and complexities can be addressed by governments as they relate to the differing regulatory, administrative and policy environments.

For many enterprises gaining access to international markets and internationalization requires much strategic support. Many firms have high fixed and sunk costs which need to be recouped as quickly as possible. Access to global markets can also offer a host of business opportunities, such as new niche markets; possibilities to exploit economies of scale, scope, volume and technological advantages; the upgrading of technological capability; lowering and sharing costs, including R&D costs; and in many cases, affording improved access to finance. Recent research findings link high-growth firms and exports, and find that exporting is not the end of a strong growth process but rather appears as a starting point to accompany the growth process (OECD, 2002).

CONCLUSION

With the large benefits, globalization comes with numbers of costs. The main costs are likely to be felt by small and micro businesses that are unable to cope with the increased competition. These small firms are usually operating only at a local level, but are nonetheless affected by the broader international environment. In addition, there will always be gains accruing to some regions or countries which have a more attractive entrepreneurial business environment. This attractiveness is relative to that prevailing in other locations and countries, and relative to the different types of entrepreneur.

A main factor impeding factor of development could be governments themselves. These impediments are difficult to monitor at present, because they are relative, not absolute, and because most are non-border impediments. There need to be better ways of identifying what government regulations and practices are impeding the startup, growth and internationalization of fast growth firms. Because many of these firms are small, and they are “pushing the envelope” in new industries and new technologies they do not show up as significant “blips” on trade negotiation. Governments need to collaborate to set up monitoring systems to identify these impediments, understand their longer-term impact, and establish mechanisms for addressing them, at bilateral and multilateral levels. The success and growth of international SMEs will be enhanced by a more internationalized infrastructure geared to the smooth growth of firms across borders. This applies to the infrastructure for financial markets, advisory services, information access, telecommunications, intellectual property rights markets and regulation, dispute resolution processes, etc. all of which need to be internationalized. All of this requires active collaboration between governments, international agencies and the private sector to address these issues with the view to create a simpler, more business friendly, and more integrated economy at international levels for Indian SMEs.