INTRODUCTION AND LITERATURE REVIEW

The current complexity of existing state tax systems has raised attention for taxpayers to request a process to be simplified to pay taxes. However, the tax systems continue to grow more complex because lawmakers view tax simplification as conflict with the current policy goal to raise public revenues. A simplified tax system could serve the same purpose of increasing revenues for the states. Also, it can achieve the goals of fairness, efficiency, and feasibility to benefit social tax policy for the state governments, industries, and individuals. Tax simplicity could lower costs of complying with the tax system in terms of time, process, and rationality for taxpayers, governments and companies. The simplified provisions could also encourage more effective social goals of college, career, investors, and retirement cost savings, etc.

A simple tax system could be structured by using broad base tax rates that have the same across different income levels or types of expenditure. A progressive system could be applied for the rate structure with rates rising with income, a basic exemption amount, and the choice of the tax base with incomes, consumptions, or other measures, rather than through specific provisions that treat different them differently. In the 1986 Tax Reform Act, the simplification method would allow tax capital gains at the same rate as ordinary income in return for reduced top tax rates. The 1986 reform also retained a limitation on capital losses to prevent the realization of losses selectively by taxpayers with gains on their investment portfolios. The continuity of this approach would reduce incentives for complex tax-planning strategies that redefine income as a capital gain. Yet, a higher capital gains rate would increase incentives to decrease or wholly avoid realizations of capital gains and put new pressure on rules, such as those for like-kind exchanges, that define when a realization event has occurred.

Brady (2020) from the National Taxpayers Union Foundation has published the complexity of the U.S. tax system that created compliance burdens and equity issues. The analysis of data from the Office of Information and Regulatory Affairs (OIRA) indicated that, altogether, to comply with the tax code in 2019 consumed a total of 7.854 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the Internal Revenue Service (IRS). With the opportunity cost of time burden and out-of-pocket, the total net tax compliance burdens have reached $367.3 billion high or 7.8 billion hours spent on tax code compliance in 2019. The U.S. business and individual income tax returns have significant net tax compliance burdens. Although, the IRS projections for the 2020 filing season showed that the overall time compliance burden associated with the tax code has fallen for the second straight year after the passage of the historic Tax Cuts and Jobs Act.

Steuerle (2001) presented the testimony of tax simplification before the United States House of Representatives Subcommittee on Oversight Committee on Ways and Means. He emphasized tax simplification was achievable if the process of reforms can be simplified more weight in the legislative process. Ryesky (2004) also commented that “changes in federal taxation, even if made in the name of tax simplification, cannot help but complicate state taxation schemes crafted in light of and geared toward the previous federal scheme.” Kopczuk (2006) had stated that “the central objective of reform should be simplifying the tax system. Reasonable simplification can adequately combat tax evasion and avoidance than traditional enforcement measures and, at the same time, simplification would make standard enforcement policies more effective without increased enforcement spending.” Gale (2007) reminded of fixing the tax system and suggested: “a good tax system can raise the revenues needed to finance government spending in a manner that is as simple, equitable, stable, and conducive to economic growth as possible.”

In the proposal of Magg (2011), the author recommended the simplified tax system could enhance the effectiveness of the child-related provisions and the college subsidies. Also, the less complex child-related visions were recommended for the IRS to administer and the families to understand tax codes. The proposal also included a further reforming of the child and work incentives into two distinct credits. Berger et al. (2017) concluded that the reform or simplification options could lower compliance burdens reduction of the resource cost of taxation. The reductions could also increase the efficiency of the process, mitigate a portion of the tax increased burden, and grow revenues for those who would already be benefiting from the proposed changes in tax law.

Kao and Lee (2013 and 2014) have developed a new tax system to simplify the existing U.S. progressive personal income rules. The advantages include eliminating the current complex Withholding Tables and using the simple method for the tax amount calculation. They also developed a linear and gradual tax system to simplify current U.S. federal and state corporate income taxation from 6-10 tax brackets to 2-4. This tax simplification system can reduce current state individual income systems with the simplified tax rate calculations.

The Tax Filing Simplification Act of 2019 (Warren et al., 2019) makes several commonsense changes to simplify the tax filing process for millions of American taxpayers and lower their costs. One of the Acts would allow eligible taxpayers with simple tax situations to choose a new return-free option, which provides a pre-prepared tax return with income tax liability or refund amount already calculated. It amended the Internal Revenue Code of 1986 to establish free online programs for tax preparation and filing service that allow taxpayers to access third-party provided tax return information. This Bill requires the Internal Revenue Service (IRS) to establish and operate the programs for the online tax preparation and the filing software that allows taxpayers to download third-party provided return information relating to individual income tax returns. It can permit individuals with simplified tax situations to elect to have the IRS prepare their returns and provide technical assistance for disclosing federal income tax return information to states. Unfortunately, the Bill was not passed and inactive by December 31, 2020.

The study of Tax Policy Center (2020) described that the benefit of making taxes simpler could improve compliance by reducing inadvertent nonpayment of taxes. On some occasions, people do not pay taxes because of the complexity of tax law. The problem could extend to tax evasion if they consider the unfairness of the tax rules exists. The taxpayers may consider the unfairness of the tax system that unfair benefits could occur in the taxation process. In order to reduce the discrepancies of economic activities and taxpayers’ characteristics, the simplified code could reduce both taxpayers’ compliance and governmental administrative costs (Kao and Lee, 2013 and 2017). Some taxpayers promote fairness, but the tax law could be simplified without compromising equity.

This paper provides benefits and values of the LG tax simplification for withholding tax, tax return, tax analysis, projection, fiscal note, and tax reform, which mean to combine and simplify existing state tax schedules, withholding tables, and withholding tax formulas for withholding tax calculations and tax table and income tax formulas for tax returns together simply. It can benefit many states to evaluate for adopting this simplification or not. Our purpose is for state governments, taxpayers, and businesses to reduce their related costs.

BENEFITS AND VALUES OF THE LG TAX SIMPLIFICATION

1. The Existing State Personal and Corporate Tax Calculation Systems and

Simplification

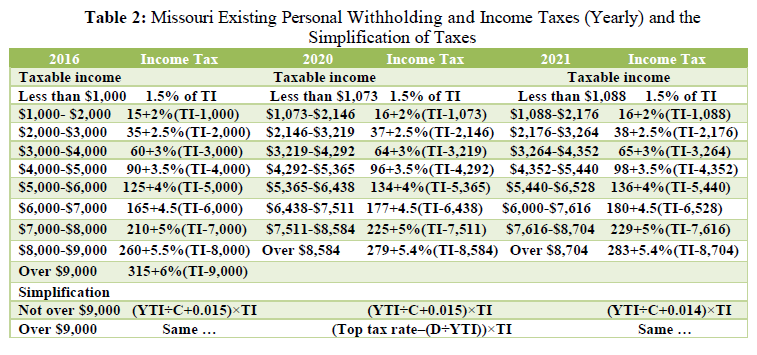

The U.S. states have different tax systems. Some states use flat tax rates for personal and corporate taxes, but others use multi-tax brackets. Flat rates can not cover different taxable incomes reasonably. Also, a flat rate cannot raise enough tax revenue or a relatively high tax rate for low and middle income, such as IL has a flat tax rate at 4.95%. It was reformed with a “Fair Tax” reform bill at 4.75%-7.99% with six tax brackets at www.ilga.gov/legislation/publicacts/101/PDF/101-0008.pdf (p.36-37) to raise tax revenue. But, the tax bill did not pass by the election in 2020. Multi-bracket personal and corporate tax systems are complex. More tax brackets would increase the complexity of the tax system. However, they are still not sufficient to meet different tax rate changes. Table 1 shows some tax systems for individual states. This basic information is from www.taxadmin.org/assets/docs/Research/Rates/ind_inc.pdf.

State corporate tax systems are usually simpler than personal tax systems. Some states have flat tax rates, like Missouri (MO) has 4% now, reduced from 6.25%. Even the flat tax rates are more straightforward, they would not serve fairly to small or large companies with different taxable income levels. A tax plan that has a relatively lower bottom tax rate can encourage more people to start businesses. Small businesses hire many employees for the development of people, society, and the economy. The median and large firms are more stable and paying relatively higher tax rates. Many states have multi-tax brackets for companies, such as AK has ten tax brackets with 1-9.4%, AR has six tax brackets with 1-6.5%, KS has two tax brackets with 4-7%, and IA has four tax brackets with 5.5-9.8%. https://files.taxfoundation.org/20201130113446/State-Corporate-Income-Tax-Rates- and-Brackets-for-2020-U.pdf.

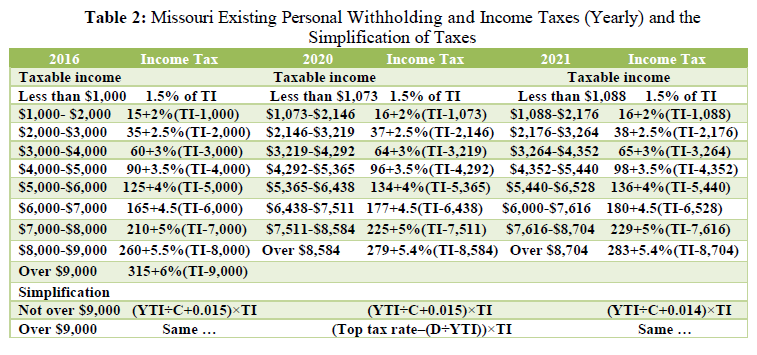

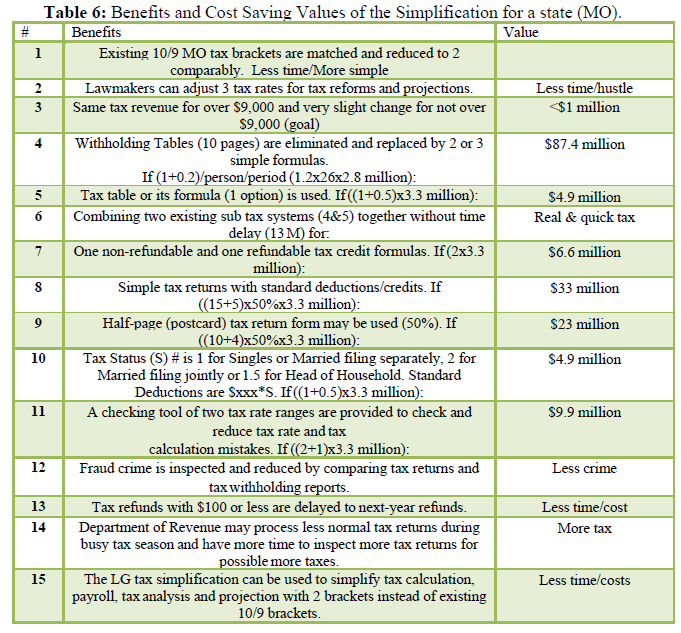

Table 2 shows MO existing personal withholding and income taxes (yearly) and their simplification with the two linear and gradual (LG) tax rates and tax formulas. MO has 10 or 9 tax brackets, different effective tax rates, and 10-page Withholding Tables, which are complex. Also, they are changed yearly during 2016-2027 by the tax laws, which are more complex. When existing 10/9 tax brackets are matched, simplified, and reduced to 2, tax analysis, tax revenue change (fiscal note), tax projection, and tax reform can be simplified. Each year has 6 income tax percentages on a yearly, monthly, semi-monthly, bi-weekly, weekly, and daily basis. Existing state tax schedules, withholding tables, and withholding tax formulas (54) for withholding tax calculations and tax table and income tax formulas for tax returns are combined together and simplified with the two simple formulas.

Its top tax rate 6% in 2016-2017 is changed to 5.9% in 2018 or 5.4% in 2019-2021. The bottom tax rate is 1.5%. With the LG tax simplification, C is 450,000 from 9,000 to divide (÷) the 1-st tax rate range difference (0.035- 0.015) and D is 225 from 9,000 to multiply (×) the 2-nd tax rate range difference (0.06-0.035) for 2016. For 2020, C is 486,486.5 from 9,000÷(0.0335-0.015) and D is 184.5 from 9,000× (0.054-0.0335). The tax formula for over $9,000 is the same. Then its taxes are not changed. https://dor.mo.gov/forms/2016%20Tax%20Chart_2016.pdf.

2016: $315 plus 6% of excess over $9,000=315+0.06(YTI-9000)= 0.06YTI - 225 = (0.06-(225÷YTI))×YTI

2020: $279 plus 5.4% of excess over $8,584=279+0.054(YTI-8584)= 0.054YTI - 184.5=(0.054-(184.5÷YTI))×YTI

YTI=yearly taxable income (YTI=TI×F), TI=taxable income, and F is filing period (1, 2, 4, 12, 24, 26, 52 or 365 on yearly, semi-yearly, quarterly, monthly, semi-monthly, bi-weekly, weekly, or daily basis), where YTI=TI when F=1.

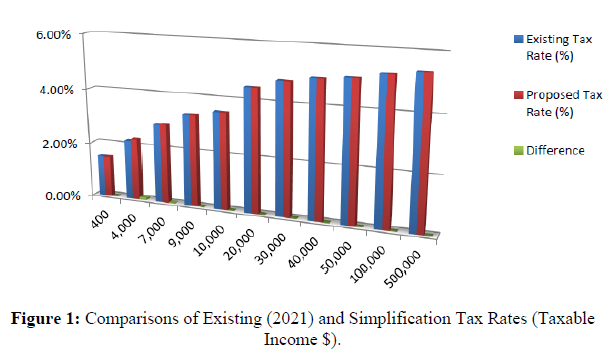

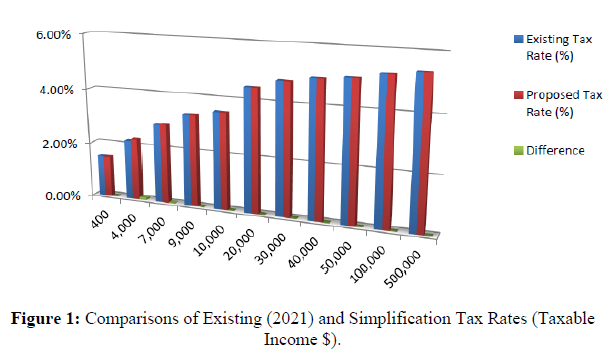

MO's existing personal tax rates are still not smooth enough, even with 9 or 10 tax brackets. With the simplification, tax rates change smoothly at the same tax rate change speed. When its bottom tax rate of 1.5% is reduced slightly to 1.4%, some people with low-end taxable incomes pay fewer taxes slightly. Overall, tax revenue may be almost neutral. For 2021, C is 468,262 from 9,000÷(0.03322-0.014) and D is 187 from 9,000×(0.054-0.03322). Their tax rate comparisons between the existing tax system and the LG tax simplification are shown in Figure 1 with very minor or no difference. 1.4% could be adjusted to 1.3% or 1.5% according to tax revenue difference (fiscal note). https://dor.mo.gov/forms/Withholding%20Formula_2021.pdf.

KS personal tax system has three tax brackets (up to eight brackets during the past 80 years), 22-page Withholding Tables, and 48 (3×2×8) formulas. The various tax brackets (3-8) can be matched and reduced to two. The complex existing 22-page Withholding Tables and 48 (3×2×8) formulas can be replaced by two formulas of (YTI÷S÷C+0.03)×TI for not over $50,000 and (0.057-(D×S÷YTI))×TI, as well as for over $50,000 with two tax rate ranges of 3*-4.785% and 4.785-5.7% (*neutral tax revenue). The original 3.1-5.7% can increase tax revenue by around $5 million slightly from not over $50,000, which was opposed by some lawmakers. Its tax status (S) # can be 1 or 2. With the LG tax simplification, CA personal tax systems with 9 or 10 tax brackets can be matched and reduced to 2 or 3. The existing 29-page Withholding Tables and 216 (9×3×8) formulas can be eliminated and replaced by simple equations, and CA's five tax statuses (S) can be used numbers of 1, 1.5, or 2.

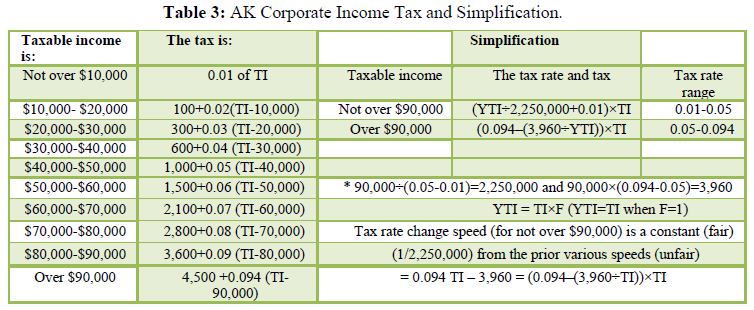

Many state corporate tax systems have 2-6 tax brackets, and their income tax simplifications also are essential. Table 3 shows AK existing corporate income tax and its simplification. The existing ten tax brackets can be matched and reduced to two. Tax rates for taxable incomes are not over $90,000 from tax simplification calculations that would be comparable with minor or no difference, as shown in another study (Kao and Lee, 2014). The formula for over $90,000 remains the same. The two LG tax rates and tax formulas could simplify the existing ten formulas. The simplified corporate tax computations and the tax rate ranges can help monitor or reduce the tax rate and tax calculation mistakes. Overall, the benefits would include tax calculation, analysis, projection, and reforms.

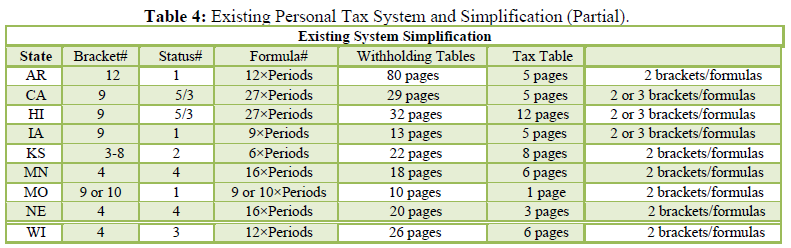

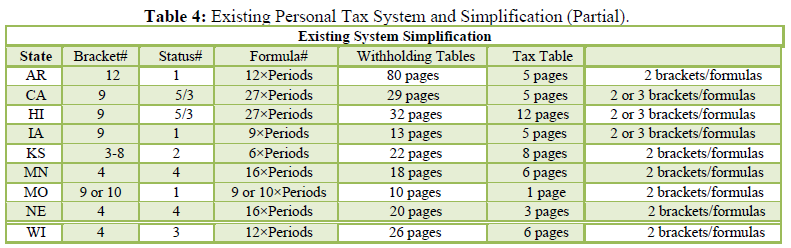

Currently, states contain 0-12 tax brackets for personal tax systems and 0-10 tax brackets for corporate tax systems. One existing issue is about their complex withholding tables. For example, AR has 80-page Withholding Tables from 12 tax brackets, IL has 18-page Withholding Tables from 1 tax bracket, KS has 22-page Withholding Tables from 3 tax brackets, and MO has 10-page Withholding Tables from 9/10 tax brackets. The two LG simplification formulas can eliminate and replace these complex withholding tables for many states.

- Withholding Tax, Withholding Table, Income Tax, Tax Table, Tax Return, Tax Evasion, Tax Fraud, and Simplification

Withholding tax and income tax are obtained from the related formulas or tables. Marginal tax rates relate to the existing tax brackets. For example, if a MO person’s yearly taxable income is $22,450, monthly taxable income $1,870.83, or biweekly taxable income $863.46 in 2021, the withholding tax calculation involves the nine tax brackets. There are about 12 steps to calculate its withholding or income tax of $1,025.28 yearly or $85 monthly (https://dor.mo.gov/forms/Withholding%20Formula_2021.pdf) by the MO Department of Revenue. When the person files a tax return, income tax is calculated by adjusting the related withholding tax. People are often confused with the difference between marginal tax rates and effective tax rates. Marginal tax rates are related to tax brackets. Effective tax rates are actual tax rates, which are calculated from taxes divided by taxable incomes. In the above case, $1,025.28 is divided by $22,450 to have a tax rate of 4.567%. When the simplified formula is used in Table 2, tax rates will include different periods such as monthly, yearly, or biweekly.

(0.054-187÷(TI×F))×TI=(0.054-187÷(1,870.83×12))×1,870.83=0.04567×1,870.83= $85.44 (monthly)

(0.054-187÷(TI×F))×TI=(0.054-187÷(22,450×1))×22,450=0.04567×22,450= $1,025.30 (yearly)

(0.054-187÷(TI×F))×TI=(0.054-187÷(863.46×26))×863.46=0.04567×863.46= $39.43 (biweekly)

The above three calculations show the same tax rate of 4.567% on different monthly, yearly, and biweekly bases.

Then withholding taxes are calculated simply by multiplying tax rates and taxable incomes. Existing tax systems have marginal tax rates and involve tax format with more calculation steps, which do not include effective tax rates directly. The LG formula involves effective tax rates and tax calculations at the same time. Using these proposed two formulas in Table 2, the taxable income of $22,450 would have a withholding tax rate of 4.567% and tax of $1,025.30 with a simple calculation of (0.054-(187÷(TI×F))×TI. There is only one step of the formula, as compared to the current 12-step process. The income tax rate and tax of 4.567% and $1,025 respectively are the same between the two methods. However, they differ in the number of steps (12 vs. 1).

Another existing way to obtain withholding taxes is from Withholding Tables. Many states have multi-page Withholding Tables are shown in Table 4. Our goal is to eliminate these complex tables and formulas for different filing periods (F) because our LG simple formulas include both tax rate and tax calculations in different filing periods. When 2 or 3 formulas are included in a spreadsheet, Excel, or software, the calculations of the tax rate, tax amount, withholding tax, and payroll will be easily reported. Accounting clerks are very familiar with this process.

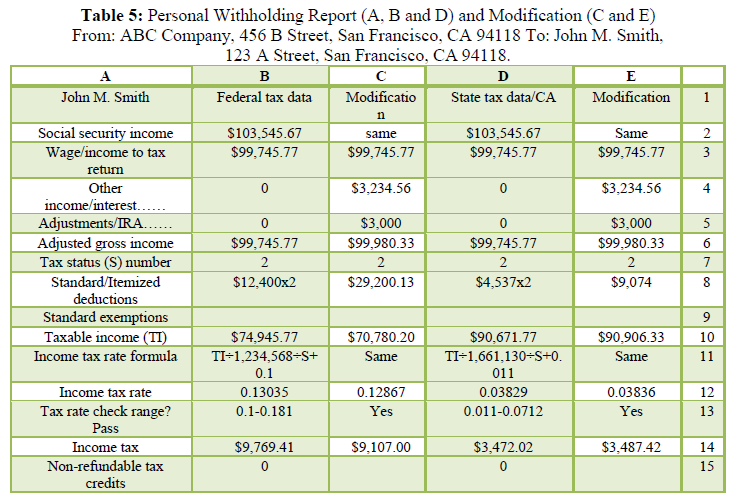

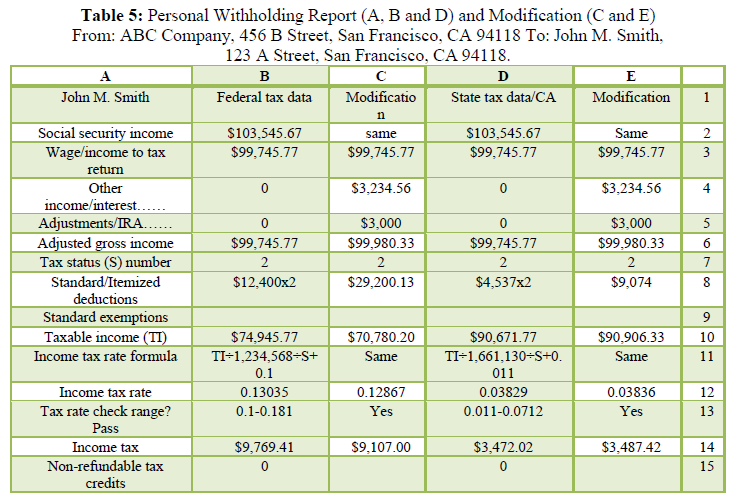

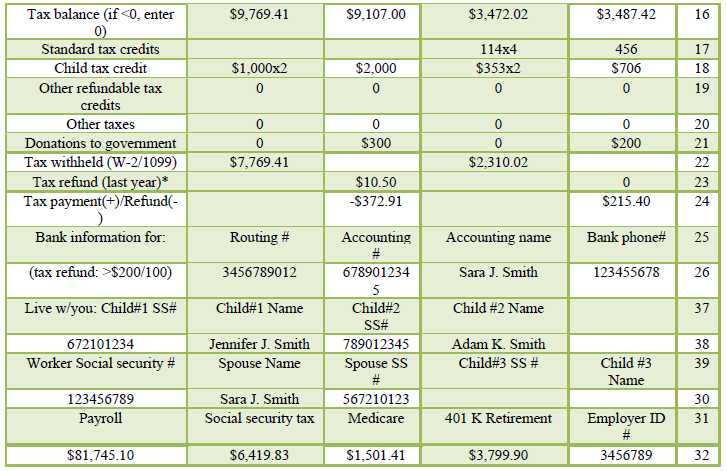

With existing state tax systems, withholding taxes are usually estimated first and then adjusted taxable income by tax returns. Also, accurate withholding and income taxes can be calculated or adjusted by simple formulas when precise tax information is available, including withholding taxes, standard deductions, exemptions, and tax credits. In the KS, the standard deduction is $7,500 for Married filing jointly has an exemption of $2,250 per person. Most taxpayers use standard deductions, exemptions, and tax credits. They may use withholding reports to modify tax returns (Table 5: C and E) and don't need to adjust the final tax returns. Hence, the state tax return forms can be reduced to half or one page.

Withholding Income Tax = (Incomes ± Adjustments –(Deductions+Exemptions)÷F) × Tax Rate - Tax Credits÷F

This formula can calculate withholding or income taxes with tax rates. Existing tax systems are in tax format and not in tax rate format. Adjustable gross income (AGI) is income ± adjustments. Taxable income is AGI-(deductions+exemptions)÷F. Tax is taxable income × tax rate - tax credits ÷ F. Filing period (F) is 1, 2, 4, 12, 24, 26, 52 or 365 with yearly, semi-yearly, quarterly, monthly, semi-monthly, bi-weekly, weekly, or daily basis.

Many states usually use tax tables for people who have simple tax filing. Tax table or its formula is one option. When the tax table is more than four pages long such as KS has an 8-page of the Tax table to cover $100,000 for Married Filing Jointly and other individuals, the long table can be reduced to a 4-page tax table for this category. If the LG tax simplification method is applied, more people could benefit from the simple formula in the long run.

Tax evasion and fraud cost millions of dollars to state governments. Existing W-2 forms provide limited information. Employers and employees use different tax systems for withholding taxes (W-2) and income taxes (tax returns). Another reason is a related timing issue. When receiving tax returns, state governments have no detailed tax information as a reference to compare and verify tax returns before sending tax refunds around one month. These reasons give delinquents a chance for possible tax evasion and fraud. The detailed reports (similar to Table 5 to replace W-2) from employers to individuals, federal and state governments can use them as references to verify tax returns, reduce tax evasion and tax fraud, and help tax compliance.

3. Tax Rate Change Speed, Checking Tool, Tax Status and Simplification

Many states have changed the existing tax rate unevenly, which means at different tax rate change speeds. Such as MO has 9 tax brackets for not over $9,000, tax rate change speeds are 0 for not over $1,000, d1/TI2 for taxable incomes $1,000-$2,000, … and d8/TI2 for $8,000-$9,000 in 2016. Their tax rate speeds always change when taxable incomes change from $1,000 to $9,000 with eight tax brackets. Some people, who should pay more slightly, pay less and vice versa because of different tax rate speeds. After the nine tax brackets are matched/simplified/reduced to 1 for not over $9,000, one tax rate and tax formula (YTI÷C+0.015)×TI is used to replace the existing 54 formulas (9×6). Its tax rate change speed is at the same fair constant 1/C. When taxable incomes change between 0-$9,000, tax rate change speed is not changed, which is fair and simple. Many other states have a similar problem. Linear tax rates for not over $9,000 (a middle taxable income) are the simplest and fair. For over $9,000, the tax formula is the same with a different format.

The existing formulas are in tax calculation format. The LG tax simplification is in tax rate and tax format, in which tax rates can be checked with some narrow ranges as a checking tool. For example, KS tax rate ranges of 0.03-0.04875-0.057 for taxable incomes not over and over $50,000 can be used as a checking tool to check and reduce the tax rate and tax calculation mistakes. If a calculated tax rate is out of its range, the result will be wrong and needs recalculation to within its tax narrow rate range.

Many states have different tax statuses, such as AZ has 2, CA has 5, HI has 5, IA has 1, KS has 2, MO has 1, MN has 4, and WI has 3 tax statuses. Simple numbers can be used, such as 2 for Married filing jointly, 1 for Single, 1 for Married filing separately, or 1.5 for Head of Household, which can be adjusted according to actual situations for a state. Tax status numbers (S) can also be used for standard deduction simplification ($×S).

- Tax Analysis, Tax Revenue Difference (Fiscal Note) and Projection

When tax brackets are reduced, withholding tables and withholding formulas are eliminated, tax analysis, tax revenue difference (fiscal note), tax reform, and projection will be simplified. For example, the MO total tax calculations can be simplified from its existing formula (1) to formula (2), which simplifies tax analysis, tax revenue difference, tax reform, and projection. For over $9,000, there is no tax change because of using the same formula.

2016 Formula (1): Total tax=0.015SumYTI1+Sum(A1+0.02(YTI2-1,000))+Sum(A2+0.025(YTI3-2,000)) +Sum(A3+0.03(YTI4-3,000))+ Sum(A4+ 0.035(YTI5-4,000))+Sum(A5+0.04(YTI6-5,000))+Sum(A6+0.045(YTI7- 6,000))+ Sum(A7+0.05(YTI8- 7,000))+Sum(A8+0.055(YTI9-8,000))+Sum(A9+0.06(YTIb-9,000))

2020 Formula (1): Total tax=0.015SumYTI1+Sum(A1+0.02(YTI2-1,073)) +Sum(A2+0.025(YTI3-2,146))+ Sum (A3+0.03(YTI4- 3,219))+Sum(A4+0.035 (YTI5-4,292))+Sum(A5+0.04(YTI6-5,365))+Sum(A6+0.045(YTI7-6,438))+Sum (A7+0.05(YTI8-7,511))+Sum(A8+0.054(YTI9-8,584)

A1 (such as 15 in 2016 or 16 in 2020 from Table 2), …A8 (8 or 7 constants), and YTI1,…YTI9 (9 or 8 groups) can be combined and simplified into C and YTIa (1 group) for 2016 or 2020. Also, a general format can cover all years. For over $9,000, the tax formula with or without a middle taxable income ($9,000) is used to calculate total tax or tax revenue.

2016 Formula (2): Total tax=0.015SumYTIa+Sum(YTIa×YTIa)÷C +Sum(A9 +0.06 (YTIb-9,000))

2020 Formula (2): Total tax=0.015SumYTIa+Sum(YTIa×YTIa)÷C + Sum(0.054 ×YTIb-D)

For all-year Formula (2): Total Tax=0.015SumYTIa+Sum(YTIa×YTIa)÷C+Sum(Top tax rate×YTIb-D)

Tax revenue difference (fiscal note) = Formula (2) - Formula (1)

2021 Formula (2): Total tax=0.014SumYTIa+Sum(YTI×YTI)÷C + Sum(0.054 ×YTIb-D)

For corporate tax analysis and projection, similar formula (1) and formula (2) can be obtained. Formula (1) is simplified to Formula (2). From Table 3, AK corporate formulas are:

Formula (1): Total Tax=0.01SumYTI1+Sum(100+0.02(YTI2-10,000))+Sum(300+0.03(YTI3-20,000))+Sum (600+0.04(YTI4-30,000))+Sum(1,000+0.05(YTI5-40,000))+ Sum(1,500+0.06(YTI-50,000))+Sum(2,100+0.07 (YTI7-60,000))+Sum(2,800+0.08(YTI8 -70,000))+Sum(3,600+0.09(YTI9-80,000))+Sum(4,500+0.094(YTIb-90,000))

Formula (2): Total tax=0.01SumYTIa+Sum(YTIa×YTIa)÷2,250,000+Sum(0.094 YTIb-3,960)

5. Tax Reform, Factor and Simplification

For tax reform, the complexity of tax bracket number, tax rate, taxable incomes range, and tax goal are affected by each other. With existing marginal tax rate systems, more tax brackets mean more smooth tax rates, complex, more cost, and more tax revenue or fewer tax brackets mean rough tax rate changes, simple, less cost, and less tax revenue relatively. Multi-tax brackets increase the complexity of tax reforms.

With the LG tax simplification, lawmakers can use two brackets to consider only three tax rates at the top, bottom, and middle for tax reform with a tax goal. Then lawmakers do not need to consider the above four factors at the same time. Many states have different situations about a middle taxable income such as $9,000 for MO, $50,000 for KS, $60,000 for IA, $100,000 and $500,000 for CA or $120,000 for MN, IL, and AZ. A common and simple middle taxable income is suggested at such as $120,000/year ($10,000/month) or $60,000/year ($5,000/month). Bottom tax rates are usually not changed. Top tax rates are often changed. Table 2 shows that the MO tax system is revised in the middle taxable income $9,000 from 3.44% in 2018 to 3.39% in 2019, and the top tax rates are revised from 5.9% in 2018 to 5.4% in 2019. Bottom tax rates are the same at 1.5%. Total tax formulas are:

2018: Total tax=0.015SumYTIa+Sum(YTIa×YTIa)÷463,917.5+Sum(0.059 YTIb – 221.4)

2019: Total tax=0.015SumYTIa+Sum(YTIa×YTIa)÷476,190.5+Sum(0.054 YTIb –180.9)

If their yearly taxable incomes for not over and over $9,000 (YTIa and YTIb) and tax credits are close or the same in 2018 and 2019, then their total tax revenue difference (fiscal note) is calculated from the above two formulas:

Total tax difference= - Sum(YTIa×YTIa)÷17,999,927 + Sum(-0.005 YTIb + 40.5)

6. Other Simplification Applications

Besides income tax simplification, there are other applications with the linear method for such as property tax credit, social security cliff, federal deduction percentage, seniors’ tax return simplification, and Earned Income Tax Credit (EITC) for many states. When two rates are set, effective (linear) rates between the two rates with a straight line are the simplest with a fair constant change speed. Existing flat and curve or step-rate with less or more tax brackets are unfair and complex with various rate change speeds. Some examples are as follows:

Example 1: MO Property Tax Credit has 53-step reductions between $14,000 and $30,000 (L13), which can be matched and reduced to 1 (98% reduction) with the simplified formula of L13 (1-(L10-14,000)÷16,000).

Example 2: KS has social security (SS) tax cliff problem. The SS benefit rate is 100% (1) when AGI is not over $75,000, and then the rate jumps to 0 after $75,000. For AGI $75,000 and Social Security $25,000, the state tax rate is about 5.2%. When two persons’ AGIs are lower and higher than $75,000 by few dollar differences, their Social Security tax difference is about $1,300 (25,000×5.2%), which is unfair. One simple linear rate formula of 1-AGI÷75,000 can be used to simplify its rates from 1 to 0 gradually with one bracket. $75,000 may be increased to $100,000 to cover more people without or with slight tax revenue change.

Example 3: Existing MO Federal Tax Percentage (MO-1040) has 5 brackets and step rates from 35% to 25%, 15%, 5% and 0%. For such as $1 AGI difference from $100,000 to $100,001 with Federal tax $15,000, $1,500 deduction difference may be caused from $2,250 (15%×15,000) to $750 (5%×15,000), which is unfair. When one simple linear formula of 0.35(1-(AGI÷125,000)) with one bracket is used with from 0.35 to 0 gradually, the unfair problem can be resolved.

7. Value and Cost of the LG Tax Simplification

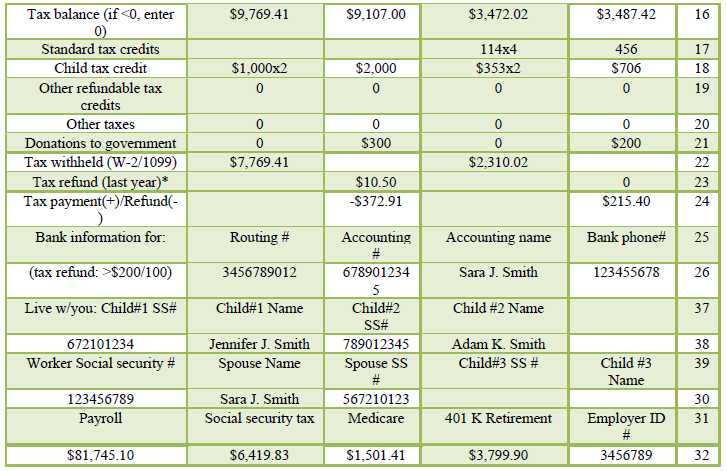

The above benefits shall have their saving values to reduce related costs. For example, MO companies can use the two simple LG formulas to replace the existing 54 formulas, 12-step process, or 10-page Withholding Tables. If the simplification can help reduce processing cost at $1 for companies and $0.2 for the Department of Revenue on every 26 biweekly periods per employee, then its cost-saving value may be reached 87.4 million from 1.2x26x2.8 million. MO has about 2.8 million employees. The $1.2 covers

about 8 areas such as (1) designing Withholding Tables, (2) publication, (3) tax numbers with certain allowances, (4) using calculation formulas for high taxable incomes and allowances, (5) checking mistakes and recalculations, (6) filings, (7) software, and (8) data analysis. Table 6 shows related benefits and value estimations with direct and non-direct values for MO, which may need to be evaluated by the Department of Revenue. Many other states have similar situations.

The direct total saving value may have $170 million for MO. Also, indirect benefits of less time, hustle, mistake, crime, and less cost have certain values. To MO Department of Revenue, the saved value may be $40 million. Many other states may have similar benefits. Cost-saving values depend on tax returns and employee numbers and the complexity of existing tax systems, which may be from millions to hundreds of millions of dollars for a state.

For a tax reform or change, the related cost involved such as the MO Personal Income Tax Withholding Percentage system is changed from 2016 to 2020 (Table 2). Tax brackets are reduced from 10 to 9 and their taxable income ranges are changed, which affects 10-page Withholding Tables. When KS existing 3 personal tax brackets are simplified to 2 and existing 6 formulas are reduced to 2, KS Division and Budget estimated $61,110 (2018) or $68,991 (2020) to implement the tax simplification and to modify the automated tax system, which is at

www.kslegislature.org/li_2018/b2017_18/measures/documents/fisc_note_hb2788_00_0000.pdf (HB 2788) and www.kslegislature.org/li_2020/b2019_20/measures/documents/fisc_note_hb2278_00_0000.pdf (HB 2278).

Slight tax revenue (about $5 million/year) can be gained by keeping 3.1%-5.7%. Values and costs need to be evaluated by departments of revenue.

CONCLUSION

In summary, the LG tax simplification could reduce the processing costs and increase revenues for the states. It can promote the tax goal of fairness, efficiency, and feasibility to benefit social tax policy for state governments, businesses, and individuals. A reasonable simplification can adequately reduce tax evasion and avoidance than traditional enforcement measures. The simplification would make standard enforcement policies more effective without increased enforcement spending. The complexity of the U.S. tax system created compliance burdens and equity issues. However, the tax reform or simplification options can lower compliance burdens and the resource cost of taxation. These reductions can also increase the efficiency of the tax system, mitigate a portion of the tax increased burden, and grow revenues for those who would already be benefiting from the proposed changes in tax law.

The proposed benefits and values in this paper are to match and reduce existing multi-tax brackets (3-12) to 2 and to simplify withholding tax, tax return, tax analysis, fiscal note, projection, and tax reform by the LG tax simplification for many states. The existing tax format is converted to the tax rate and tax format, which can be used to eliminate existing multi-page withholding tables. Many state tax systems have multi-page (up to 80 pages) withholding tables. With the LG tax simplified formulas, accurate results can be obtained when accurate tax information is provided, and tax calculation, analysis, reform, and projection can be simplified. Taxpayers with standard deductions and tax credits do not need to do the normal tax returns with the simplification method. The benefits have related values as estimated in the study. Cost-saving values depend on tax returns, employee numbers, and the complexity of existing tax systems, which may reach a hundred million dollars for a state. This paper can benefit states to evaluate and adopt the LG tax simplified formulas to benefit governments, businesses, and taxpayers by reducing their related costs.