Research Article

AN ESTIMATE OF AWARENESS SKILL LEVEL IN FINANCIAL INSTRUMENTS AMONG MANAGEMENT STUDENTS

2949

Views & Citations1949

Likes & Shares

The financial literacy is the requisite for development and growth of the economy. The pedagogy for the delivery of financial knowledge in Indian management schools is both with e-technology and traditional methods. The financial instrument is a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

The awareness of financial instruments and skill to invest in these instruments is awareness skill. The study is designed to estimate the awareness skill level of financial instrument of management students. The research design formulated for the study is descriptive with a sample of 131(10 % of the sample) drawn randomly from students of post graduate level pursing professional management courses. The schedule with 24 items is administered and the results are analyzed with percentages and ANOVA.

The first null hypothesis of low awareness skill is accepted and other two null hypotheses are rejected. There is a significant variation of awareness skill level of financial instruments with focus on gender and specialization. The awareness skill level is confined to fixed deposits and recurring deposits.

Keywords: Awareness skill level, Financial instruments, Commodities, Management students, Forward market

INTRODUCTION

The financial literacy is the requisite for development and growth of the economy. The savings add to the gross national savings. The finance as a subject of management is relevant to understanding the functioning of the business. The pedagogy for the delivery of financial knowledge in Indian management schools is both with e-technology and traditional methods. The learning of the theoretical issues of financial management happens at the undergraduate and graduate levels. The financial instruments are the products for saving and commercial transactions in business and domestic activities. The awareness skill of financial instruments is important for decision making at the individual and organizational level.

The saving habits of India have grown from 7.9 % in 1954 to 30.5 % in 2018. The world average gross saving rate in 2017 is 25.33 % with China at highest (World Bank National Accounts Data, 2018). The Global Financial Market Literacy Survey in 2012 has ranked India at 23rd position within 28 member countries (Visa Global Financial Literacy Barometer, 2012). Presently, India is preoccupied with highest youth population in the world and skilling in domain knowledge is a major concern. The knowledge is power for development of the society. The youth is the most valuable segment and demographic dividend for the development of the country (UNDP, 2018). The financial awareness skill skills of the youth are the propeller for growth. The investment in the management education to enhance the knowledge of the student population will direct to balanced growth (Annamaria Lusardi and Olivia S. Mitchell, 2014). The role of financial awareness skill skills has become more important to manage these personal spending and savings. The financial planning is an integral part of an individual's life. The work-life span ratio of an individual is one of the determinants of financial status. The financial awareness skills an integral part of human life (Lusardi A, 2015).

The learning outcome is a measure of the effective teaching and learning ability of the students. The present problem of learning deficiency is a prefecture to be addressed by the management schools. The measuring of learning is difficult on account of deficiencies and difference in abilities of the students. The factors influencing the personal learning capabilities differ on delivery, region, language, psychology and biological issues. The learning poverty is measure of demonstrated skill of financial awareness skill and is linked to poverty alleviation (World Bank Report, 2019). The learning of financial issues is essential for management students.

The earlier studies of Furnham and Argyle (1998) presents male are more risk takers than females in financial issues and active in financial transactions (Furnham, 1999). The financial knowledge, credit card ownership and spending pattern of students are examined by Hayhoe, Leach and Turner (1999) and established linkage with saving as low. The factors examined in the study are financial behaviors, financial self-efficacy, and financial knowledge. The saving culture increases with financial awareness skill (Danes, Huddleston-Casas, & Boyce, 1999). Agarwal Sumit, et al, (2011) survey finds low knowledge level on financial instruments but expressed interest in savings for retirement. The study by Pritchard, Myers, & Cassidy (1989) on the spending and saving habits of the students in United States have found the financial knowledge of savers and necessity spenders are more than discretionary spenders. The socio-economic background of the family is a determinant of financial knowledge.

Varcoe, Martin, Devitto, & Go (2005) have found a linkage of higher financial knowledge in students with financial curriculum in the course. Peng et al., (2007) research study finds the finance courses develop saving habits at the college level. The course on financial skills increases the use of cash to credit for better financial control (Jobst, Vicki, 2009).

The Securities Exchange Board of India is entrusted with the task of promoting financial learning and inclusion in the curriculum of the Indian education with participation from universities. The unclaimed dividends and penalties paid by Corporate Firms are utilized by SEBI for promotion of financial learning.

In India, the students from financial backward households are concerned of financial issues and accord priority in financial learning (Dewan, Goel, & Malhotra, 2013; Firmansyah, 2014). The financial discipline is low among college students with more spending and less investment (Balint & Horvathne, 2013) and higher debt (Anya Kamenetz, 2006). The financial learning will improve with reinforcement technique and lower poverty is the outcome (Rodriguez & Saavedra, 2015).

FINANCIAL INSTRUMENTS

The financial instrument is a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity (Indian Accounting Standards, 2015). The financial instrument is derived from a financial object capable of transaction with monetary value and is a legal contract. The exchange value may be with added interest or premium linked to market demand and supply for such product.

The financial instruments transactions in India are under the regulated control of Securities Exchange of India, Commodities Exchange of India, Reserve Bank of India and Ministry of Finance. The approved financial instruments in circulation are:

- Equities: The equities are tradable instruments with ownership rights. The equities are tradable at equity stock exchanges. The Securities Exchange Board of India is responsible for regulating the equity market.

- Derivatives: Derived from the underlying asset value of the product. The financial contracts are protection from price fluctuations. The equity shares or asset classes may be converted into derivative.

- Bonds and Debts: The bonds are class of instruments classified as debt. The debt instruments carry financial value with interest and are tradable instruments.

- Mutual Funds: The fund formed with the contribution of group of investors in units. The proceeds from the fund are invested in tradable financial instruments for monetary gains. The profits are distributed to the unit holders on proportionate basis.

- Fixed and Term Deposits: The fixed and term deposits are offered by banks, post office and corporate companies. These deposits based on interest withdrawal are classified into cumulative schemes or interest withdrawal schemes. The deposit is made in lump sum.

- Recurring Deposits: These deposits are for a time period with part contribution in equal installments. The equal installments are deposited either daily or weekly or fortnightly or monthly or quarterly or half yearly or yearly.

- Gold Based Funds: The gold asset value is converted into units and operates as a tradable instrument. The value of the instruments is calculated on the open market price of gold and premium for future value.

- Commodities: The commodities are financial instruments with monetary value and derived from a commodity. The monetary value is based on market demand and supply of the commodity. The commodities may be agro-products or minerals.

The curriculum of management courses includes the basics and complex issues of financial management. The knowledge of common financial instruments is judged by their skill to manage the portfolio of bank deposits, post offices saving deposits and other financial instruments.

Present Study

The awareness skill of financial instruments is defined for the purpose of this study as awareness of financial instruments and skill to invest in these instruments. The study is designed to:

- estimate the awareness skill level of the financial instruments within the students pursuing the management courses

- estimate the difference in awareness skill level of students' gender wise and domain specialization wise.

Hypothesis

H01: The awareness skill level of the students of management courses on financial instruments is low

H02: There is no gender wise difference of awareness skill level on financial instruments within the students of management course

H03: There is no domain specialization wise difference of awareness skill level on financial instruments within the students of management course

METHODOLOGY

The study is aimed at examining the financial awareness skill of selected financial instruments. The socio-demographic and specialization are also considered for evaluation of financial awareness skill. The students pursuing management courses only are included in the study.

The research design formulated for the study is descriptive with the sample drawn from students of post graduate level pursing professional management courses. The sample of 131 is drawn randomly from 1360 students of management course population in Visakhapatnam. The sample is 10 % of the population with five schedules discarded. The standardized instrument with 24 questions with 80 items is adopted after conducting pilot study on 30 management students and rejecting inconsistent questions. The percentage and means are calculated for analysis and the relationship is tested with One Way Analysis of Variations.

The test result of Cronbach’s Alpha test is (Alpha Coefficient = 0.7299; post standardized alpha coefficient = 0.8371) within the acceptable limits (>=0.6). The questionnaire is standardized by discarding some items with low individual alpha coefficient value.

RESULTS AND DISCUSSION

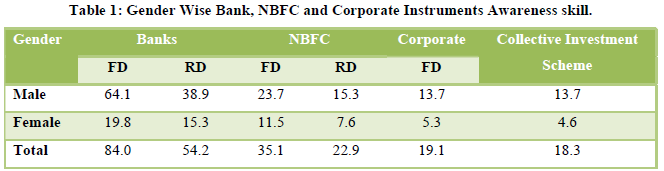

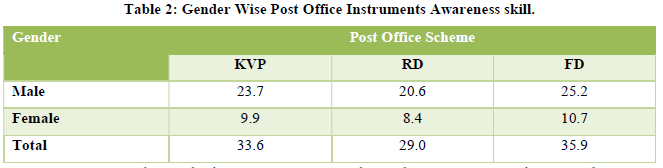

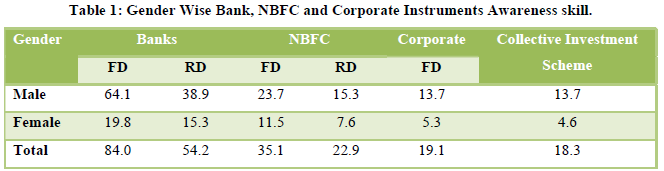

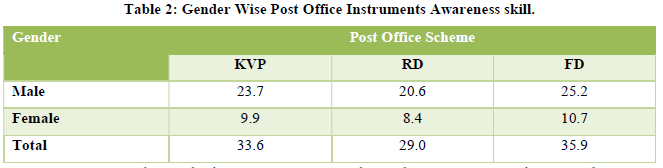

The awareness skill of the financial instruments is tested and analyzed across the selected sample. The result presents (Tables 1 & 2) awareness skill of males is more than females on bank FD and RD’s.

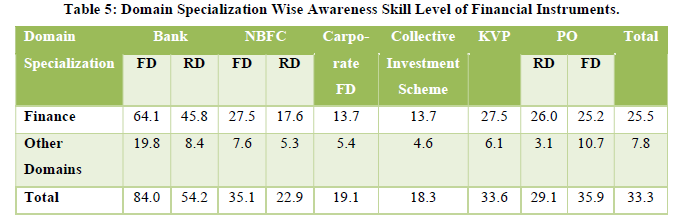

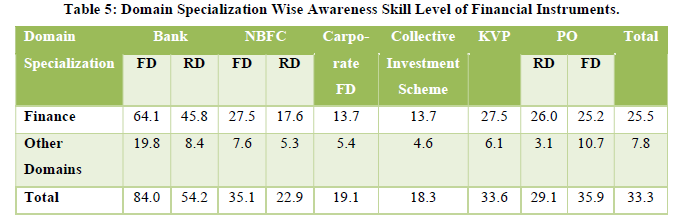

The analysis presents more male students are aware about Banks, NBFC, Post Office and Corporate Debt instruments for saving than females. The awareness skill on Non-banking Financial Corporation and their instruments is low (39 %) and female awareness skill is very low (7.8 %). In the Banking category 84 % (male 64.1 %; female 19.8 %) are aware of FD whereas for RD the awareness skill level is 54.2 % (male 38.9 %; female 15.3 %). The post office schemes awareness skill for Kishan Vikas Patra is 33.6 % (male 23.7 %; female 9.9 %) and for recurring and fixed deposit scheme are 29 % (male 20.6 %; female 8.4 %) and 35.9 % (male 25.2 %; female 10.7 %) respectively. The Corporate debt schemes presents a dismal picture, the awareness skill level for Corporate FD (Table 1) is 19.1 % (male 13.7 %; female 5.3 %) and for collective investment scheme is 18.3 % (male 13.7 %; female 4.6 %).

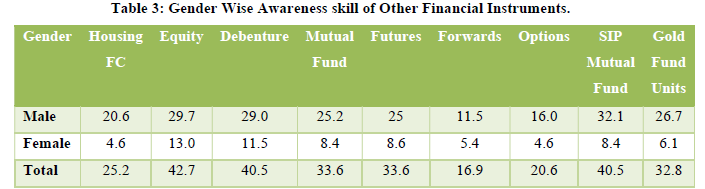

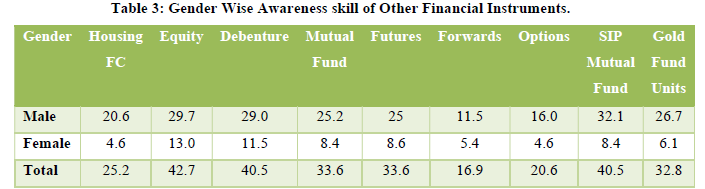

The gender-based response of students on awareness skill on Housing Finance Companies (Table 3) is miserably low (4.5 %) for female and for male group is better (20.6 %). The awareness skill of stock market instruments is higher for males (29.3 %) than females (12.25 %). The abysmally low awareness skill among females is presented in Table 3. The futures and forward market and its instruments awareness skill are low (23.7 %). The mutual fund market awareness skill is better (35.66) compared to stock market instruments. The gender-based comparison is skewed in favor of male for stock market and mutual fund. The awareness skill of Mutual Fund, SIP Mutual Fund and Gold Fund units for male category are 25.2 %, 32.1 % and 26.7 % respectively whereas for female category are 8.4 %, 8.4 % and 6.1 % respectively.

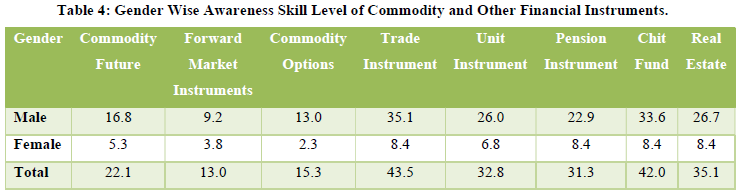

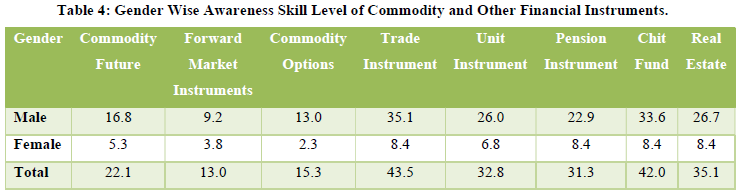

The data on awareness skill of commodity market and its instruments (Table 4) presents, males (14.9 %) have comparatively better awareness skill than females (6.45 %). However, the awareness skill level is very low for both male and females. The awareness skill level for commodity futures and commodity options for males is 16.8 % and 13.0 % whereas for females is 5.3 % and 2.3 % respectively. The awareness skill of Forward Market Instruments and Trade Instruments for males is 9.2 % and 35.1 % whereas for females is 3.8 % and 8.4 % respectively. The pension instruments awareness skill is abysmally low for females (8.4 %) than for males (22.9 %). The chit fund and real estate awareness skill levels are 42.0 % and 35.1 % respectively.

The student’s specialization wise analysis presents the awareness skill level of students with Finance domain is higher than Other Domains (Table 5). The finance domain students’ awareness skill for Bank FD is higher than FD’s of NBFC (35.1 %), PO (35.9 %) and Corporate (19.1 %). Further, for RD Bank Instruments awareness skill level is higher than RD’s of NBFC (22.9 %) and PO (29.1 %). The awareness skill of Collective Investment Scheme within Finance and Other Domains is 13.7 % and 4.6 % respectively. The awareness skill of the financial instruments for Finance and Other Domains specialization students are 25.5 % and 7.8 % respectively.

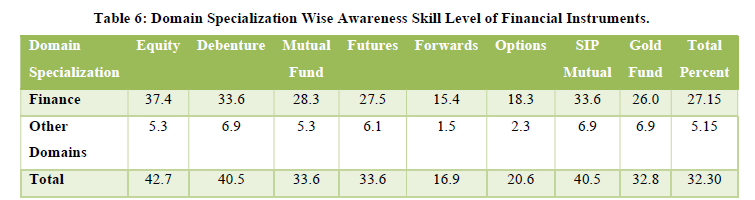

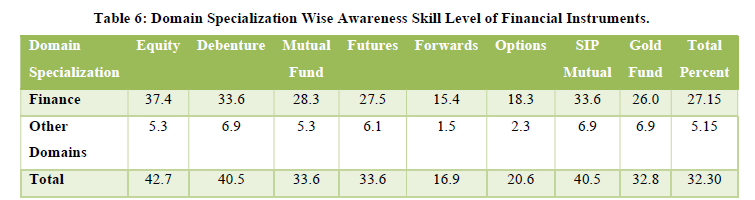

The results (Table 6) on market operated instruments' presents Finance specialization students to the extent of 27.15 % are aware of equity (37.4 %), debenture (33.6 %), mutual fund (28.3 %), futures (27.5 %), currency forwards (15.4 %), options (18.3 %), systematic investment plan in mutual fund (3.6 %) and gold fund units (26.0 %). The awareness skill of financial instruments from Other Domains is 5.15 %.

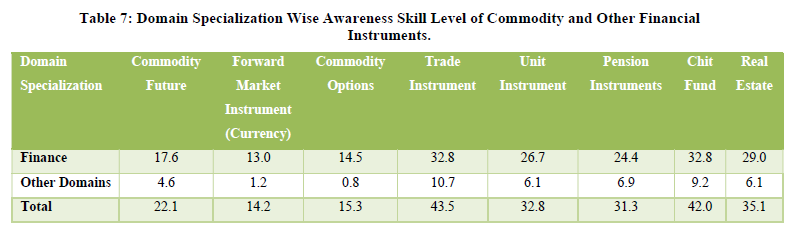

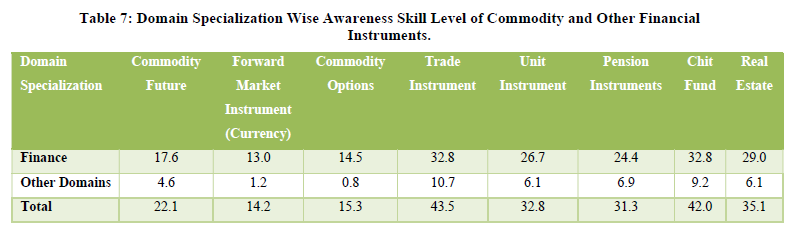

The terms Commodity Future, Forward Market Instruments, Commodity Options, Trade Instruments, Unit Instruments, Pension Instruments, Chit Fund and Real Estate (Table 7) is having high learning deficiency on awareness skill with 76.15 (100-23.85) %. The awareness skill of finance students for trade instruments is 32.8 % whereas for students from Other Domain areas are 10.7 %. The financial awareness skill level for Other Domain areas of specialization with respect to exchange tradable instruments of commodities, currency, mutual units and pension units is very low (5.05 %). The awareness skill level of operation of Chit Fund and Real Estate instruments for finance and Other Domains are 30.9 % and 7.65 % respectively. The combined awareness skill of exchange tradable instruments of commodities, currency, mutual units and pension units is 26.33 % and for Chit Fund and Real Estate is 38.55 %.

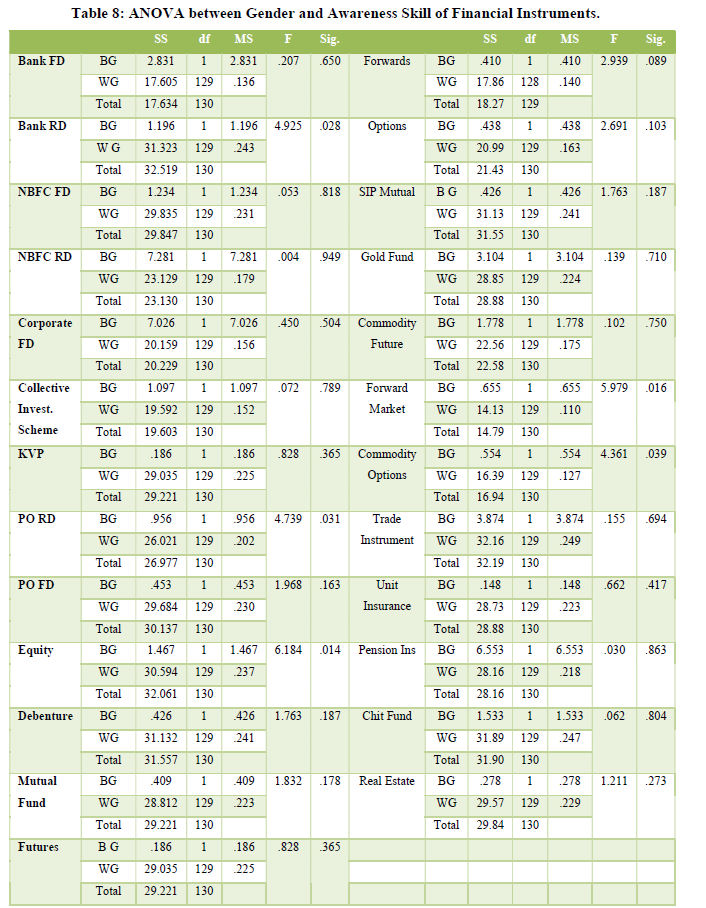

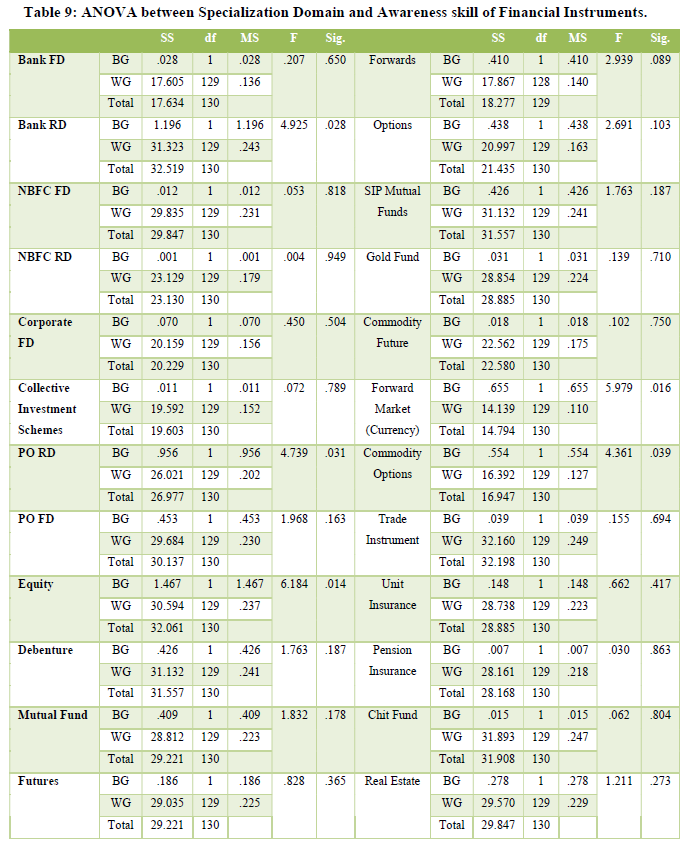

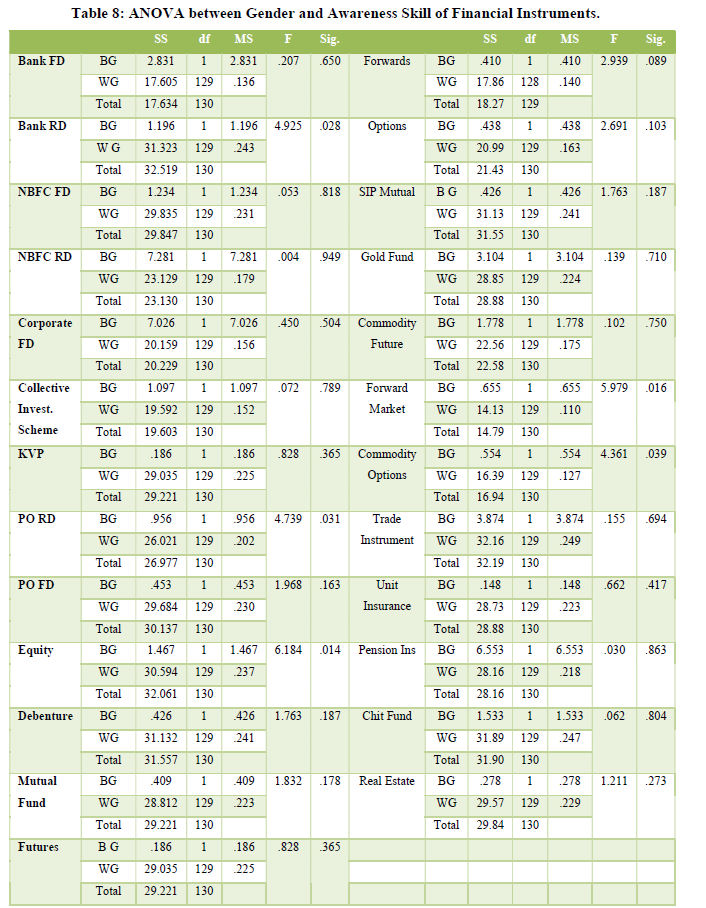

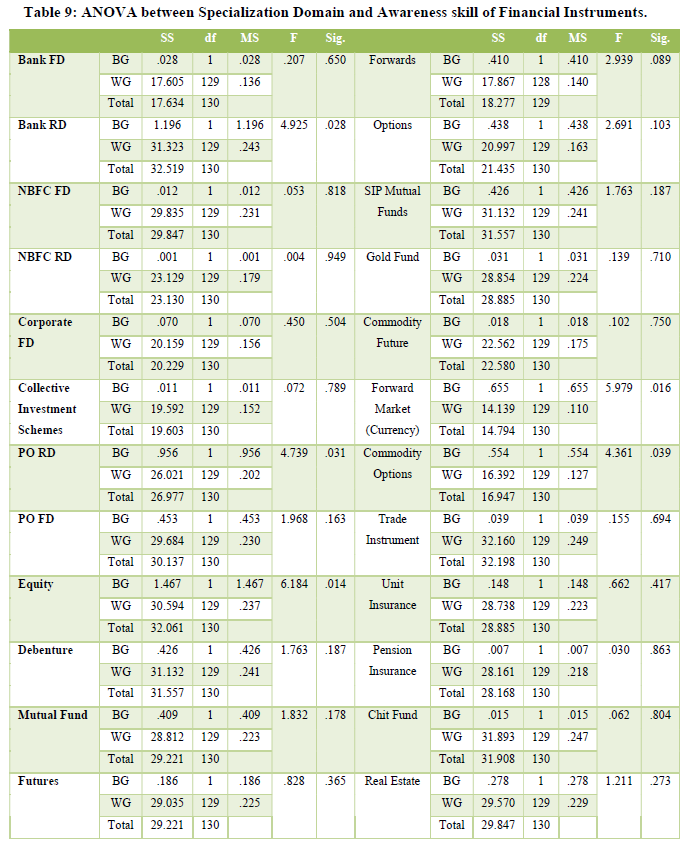

The One-Way ANOVA results (Table 8) present significant variations between Gender and awareness skill of the financial issues connected with each of the financial instruments. The gender is significant at 10 % with Recurring Deposits of Bank and Post Office, Equity, Commodity Futures and Options and Forward Market (Currency). The trend of awareness skill across the above financial issues presents variations. The domain specialization and the awareness skill level (Table 9) of the students have significant variations at 10 % level for recurring deposits of Banks and Post Office, Equity, Equity forwards, Forward Market (Currency) and Commodity Options.

The first null hypotheses i.e., H01: The awareness skill level of the students of management courses on financial instruments is low, framed for the study is accepted, since the awareness skill level is less than 32.8 %. The other two null hypotheses H02 and H03 are rejected, there is a significant variation of awareness skill level of financial instruments with focus on gender and specialization. The awareness skill level is confined to fixed deposits and recurring deposits.

CONCLUSION

The financial awareness skill of the management students from different domain specializations is observed in the study. The operational definition of awareness skill level is the knowledge and ability to invest independently. The students of management courses across the domain specialization are lacking in the financial skills on the key financial instruments. Furnham and Argyle (1998) findings on gender variations in awareness are supported by this study and adds awareness skill is low. The new generation is dependent on elder family members for basic business or day to day financial issues. Therefore, the awareness skill level with ability to make investment decisions is very low.

The skill orientation in the course curriculum is the cause for low awareness skill level. The management courses need to be revised to meet with the life or work skill expectancies. The employable skills for financial domain students require attention of the education policy makers.

- Agarwal Sumit, Amromin Gene, Ben-David Itzhak, Chomsisengphet Souphala, Evanoff Douglas (2011). Financial Counseling, Financial Literacy, and Household Decision-making. In: Mitchell OS, Lusardi A, editors. Financial Literacy: Implications for Retirement Security and the Financial Marketplace. Oxford: Oxford University Press. pp: 181-205.

- Annamaria Lusardi, Olivia S. Mitchell (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature 52(1): 5-44.

- Anya Kamenetz (2006). Generation Debt. Riverhead Books: New York.

- Balint A, Horvathne AK. (2013). Saving habits of Hungarian college students. European Scientific Journal 9(34): 1857-7881.

- Birari A, Patil U. (2014). Spending & Saving Habits of Youth in the City of Aurangabad. The SIJ Transactions on Industrial, Financial and Business Management 2(3): 158-165.

- Companies (Indian Accounting Standards) Rules (2015) Accounting Standards Board., New Delhi: Institute of Chartered Accountant of India.

- Cravener G. (2007). The impact of personal finance education delivered in high school and college courses. Journal of Family Economic Issues 28: 265-284.

- Danes SM, Huddleston-Casas C, Boyce L. (1999). Financial Planning Curriculum for Teens: Impact Evaluation. Retrieved on: April 28, 2016 from Association for Financial Counseling and Planning Education.

- Dewan A, Goel DR, & Malhotra R. (2013). Student’s perception regarding student financing (a case study of Palwal and Faridabad district of Haryana). International Journal of Social Science & Interdisciplinary Research, 2(7): 97-103.

- Firmansyah D. (2014). The influence of family backgrounds toward student’s saving behavior: A survey of college students in Jabodetabek. International Journal of Scientific and Research Publications 4(1): 1-6.

- Furnham A. (1999). The saving and spending habits of young people. Journal of Economic Psychology 20(6): 677-697.

- Furnham A, Argyle. (1998). The psychology of money. London: Routledge.

- Hayhoe C R, Leach L, Turner P R (2016). Discriminating the Number of Credit Cards Held by College Students Using Credit and Money Attitudes. Journal of Economic Psychology 20(6): 643-656.

- Jobst V J. (2009) The 800 Pound Gorilla in the Room: Changing College Students’ Spending and Saving Habits.

- Lusardi A (2015). Financial literacy: Do people know the ABCs of finance? Journal of Public Understanding Science 24(3): 260-271.

- Peng T M, Fox A J J, Bartholomae S, Cravener G, Martina T C, et al. (2007). The impact of personal finance education delivered in high school and college courses. Journal of Family Economic Issues 28: 265-284.

- Pritchard M E, Myers B K., Cassidy D J. (1989). Factors associated with adolescent saving and spending habits. Libra Publishers Inc., XXIV: 95.

- Report on Learning Poverty-2019. Washington: World Bank.

- Rodriguez C, Saavedra J E. (2015). Nudging Youth to Develop Savings Habits: Experimental Evidence Using SMS Messages. Cesr-Schaeffer working paper series, 2015-018. Scientific and Research Publications.

- The Editor (2012). India Lags in Financial Literacy with Women and Young People Most at Risk. Visa 2012 Global Financial Literacy Barometer. Accessed on: January 08, 2020. Available online at: https://www.businesswireindia.com/india-lags-in- financial-literacy-with-women-and-young-people-most-at-risk-visa-2012-global-financial-literacy-barometer-31541.html

- UNDP (2018). National Human Development Report-Planning the Opportunities for a Youthful Population. New York: United Nations.

- Union Budget Papers (2016). Economic Survey 2015-16. Government of India Publication: New Delhi.

- Varcoe, Karen, Martin, Allen, Devitto, Zana, Go, Charles (2005). Using a Financial Education Curriculum for Teens. Journal of Financial Counseling and Planning 16(1): 63-71.

- World Bank Accounts Data (2018). Gross Domestic Savings-China. Accessed on: December 20, 2019. Available online at: https://data.worldbank.org/indicator/NY.GDS.TOTL.ZS?locations=CN